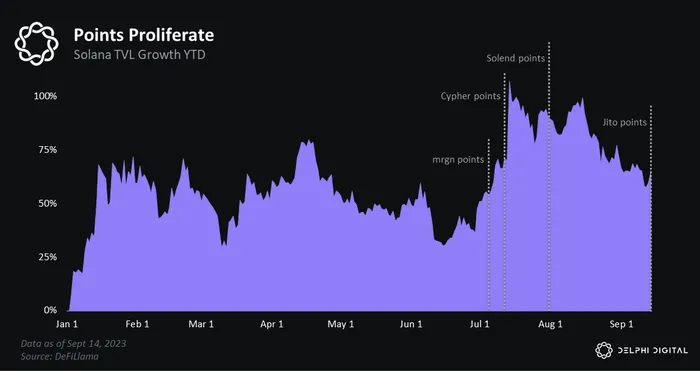

Jito — the MEV-powered liquid staking provider on Solana — just became the latest DeFi protocol to launch a points program. We’ve been following Solana’s points meta for awhile, so see this blog post and Ghost of Cycles Past report for more deep divey thoughts. This post will skew more degen-y.

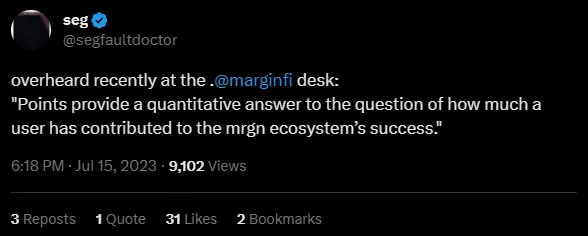

At a high level, points are a way to quantify and reward users’ contributions to a protocol.

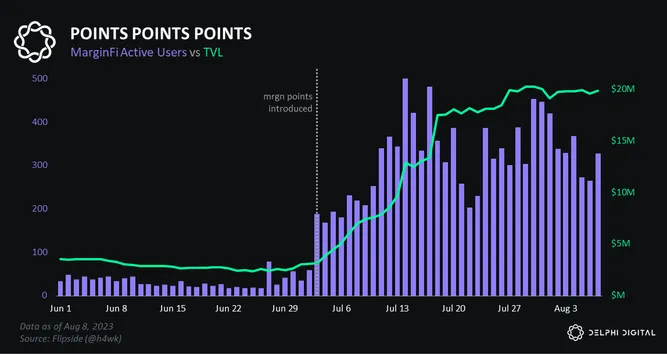

We’ve seen several Solana DeFi protocols unveil points programs, including MarginFi, Cypher, Solend, and now Jito.

With all these points poppin up, it’s worth asking: what’s the best strategy for stackin ’em?

Disclosure: none of this is investment advice. Proceed with caution; these strategies involve several layers of risks.

Let’s start our very sophisticated DCF analysis on points by comparing each of the points programs.

-

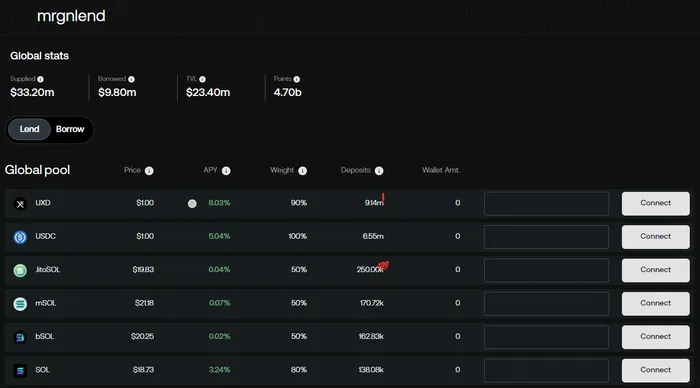

$1 lent = 1 point per day

-

$1 borrowed = 4 points per day

-

referring users also earns you points. see mrgn blog for the maths

-

$1 perps (maker) volume = 20 points

-

$1 perps (taker) volume = 15 points

-

$1 spot (maker) volume = 10 points

-

$1 lent = 1 point per day

-

$1 borrowed = 5 points per day

-

note: cypher just announced its $CYPH tokenomics; its point program is still live (for now), but the plan is to deprecate it when the CYPH token launches

-

$1 margin trading volume = 10 points

-

10M points are distributed per day

-

lending/borrowing points are distributed proportionally to global lend/borrow

-

solend points have “seasons.” the ongoing season 1 has 100k SLND and will last ~3 months

-

see solend blog for the maths

-

1 jitoSOL = 1 point per day

-

1 jitoSOL in money market (marginfi, solend) = 1.5 points per day

-

1 jitSOL in liquidity pool (orca, raydium) = 2 points per day

-

referrals earn you 10% of points they earn

Alright, so now that we have all the numbers in one place, how can we play this points meta in a GTO fashion? Well, ideally, you want to combine as many points programs as you can to really maxx your rewards. Here’s one idea:

Let’s assume you have $20,000 good ole uncle sam bucks. You turn $20k USD into 1,000 SOL ($20/SOL). You then head over to Jito and stake that 1,000 SOL for 944 jitoSOL, where you’ll earn ~6.9% on your staked SOL.

You now have options. You can LP your jitoSOL on Solana DEXs like Orca, but most of these pools are unincentized and thus don’t offer great yields. Many would also put your schmoney at risk of IL, too.

So wat do? Well, an alternative strategy to LPing, is to dump your jitoSOL into a money market protocol like marginfi and earn additional interest on your deposits. Granted, it’s not that much @ 0.04% APY for jitoSOL deposits, but it’s something. You’d also be earning mrgn points in the process. And if you really wanted to get crazy, you could then borrow against your jitoSOL deposits and do some looping. Anders from marginfi had a good thread on this.

Okay so let’s say you want to loop. One rewards-maximizing strategy you could pursue is to borrow USDC against your jitoSOL collateral and eat the 7.7% borrow APY. Then flip your USDC into UXD and deposit all the UXD back into marginfi to earn an incentivized ~8% yield. So, you wouldn’t be making that much on the yield spread, but you would be juicing your marginfi points and also getting some upside exposure to UXP (UXD protocol’s gov token), which makes up ~7% of UXD’s total 8% yield.

On a pure points basis, this is probably one of the better Solana DeFi strategies right now. If you were to do this with 20k USD, here’s the total points you would stand to make across Jito and marginfi:

-

$20,000 = 1,000 SOL (1 SOL = $20)

-

1,000 SOL = 944 jitoSOL

-

jito points — 944 jitoSOL in marginfi = 1,416 jito points/day and 520,490 jito points/year

-

marginfi lending points — 944 jitoSOL in marginfi = 20,000 mgrn points/day and 7.3 million mrgn points/year

-

marginfi looping points — if we assume you borrow the max USDC against your jitoSOL collateral, then you’d have 5,000 USDC

-

5,000 USDC marginfi borrow = 20,000 mrgn points/day and 7.3 million mrgn points/year

-

5,000 UXD marginfi deposit = 5,000 mrgn points/day and 1.825 million mrgn points/year

-

So, in summation, your annual rewards across protocols employing this points maxxing strat would look something like this:

-

520,490 jito points

-

16.425 million mrgn points

-

< $100 interest income from USDC-UXD rate spread, assuming rates stay constant and you immediately dump all UXP rewards

Anyway, this is just one strategy to consider; there are many more to explore. And hopefully, far more salient opportunities still lie on the horizon as Solana DeFi continues to stage an impressive post-FTX recovery. Happy points farming!