Liquidity this liquidity that, but what exactly is liquidity? Specifically, what is liquidity in crypto?

The question becomes more pressing when we consider major MMs withdrawing from the market coupled with a constant MoM decline in stablecoin MC.

Generally, liquidity is defined as the ease with which an asset can be converted for cash.

In the land of our magical internet money, the ease with which something can be converted for stablecoins is one way to imagine liquidity. But what dictates liquidity? Liquidity is broadly a function of interest rates and the number of market participants.

High-interest rates = lower liquidity

Low interest rates = higher liquidity

More market participants = higher liquidity

Fewer market participants = lower liquidity

Simple, right?

Since stablecoins are essentially dollars on the blockchain, increasing/decreasing MC becomes a function of interest rates.

So, crypto liquidity = stablecoin MC? Yes, but there is another piece to this puzzle. Our market is constantly flooded with new projects every single day. Every new project fights for its piece of the liquidity cake.

So, more projects = thinner liquidity

less projects = thicker liquidity

Based on the above, crypto liquidity = no. of projects/stablecoin MC.

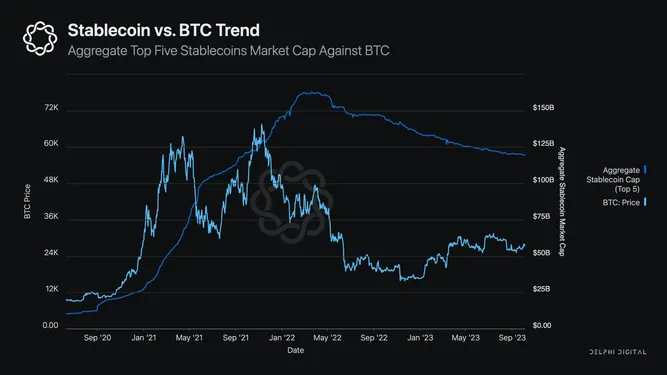

All that said, is the liquidity increasing or decreasing? Consider this chart, we can see that increasing stablecoin MC translates to bullish PA & vice-versa.

And since the money printer was paused in Nov. 2021, we can see that the stablecoin MC has been declining as well.

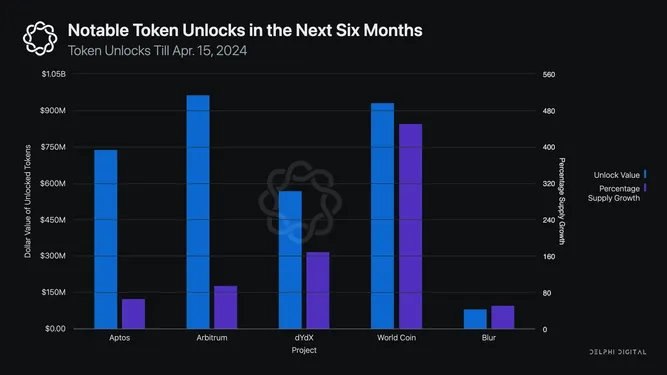

But the number of projects is always increasing. Not only is the denominator decreasing, but the numerator is increasing, further thinning out the market liquidity. To make things worse, most of the VC-backed projects launched in the bull market with low initial floats. But now, in a time of scant liquidity, the remaining supply keeps unlocking, making it harder to sustain prices owing to declining liquidity.

Even if a pause was put on new project launches, the mass supply expansion + declining stablecoin MC is enough to drain liquidity.

To put things into perspective, if we combine the dollar value of token unlocks for four major projects in just the next 6mo, it would amount to over $3B at current prices.

The current market conditions are clearly not conducive to absorbing such selling.

Of course, there are more things to consider when it comes to crypto liquidity. And fret not; we have dedicated an entire section towards doing just that in our upcoming Monthly Markets Report, so make sure to check it out!