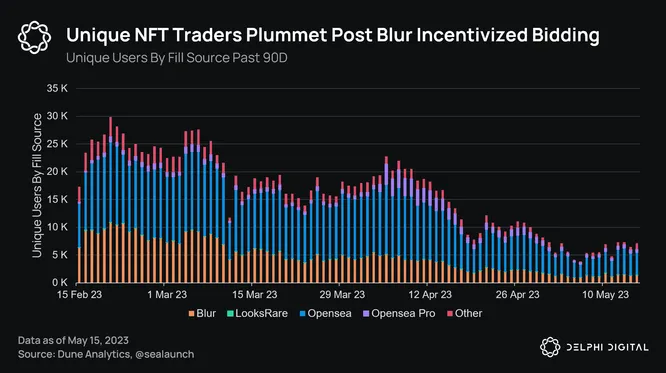

Since the launch of Blur’s incentivized bidding system in mid-Feb, the number of unique users by completed trades has plummeted by 75%. Blur incentivizes traders to bid ETH near floor prices to create tight price intervals. Theoretically, tighter ranges increase concentrated liquidity, which reduces slippage for traders and incentivizes more trading on the platform.

However, Blur’s bidding system has become a game of hot potato between whales. Whales are betting on BLUR rewards being more valuable than the loss incurred from NFTs being sold into their bids. Unfortunately for NFT communities, the floor price of their collections is constantly being pushed lower, causing many holders to capitulate. It is yet to be seen if Blend (Blur’s P2P lending platform) will increase NFT trading participation.

Blur’s impact on the NFT marketplace and its communities will undoubtedly catalyze project-specific exchanges and whitelisted exchanges (by blacklisting non-royalty exchanges). Unfortunately, these ideas are against the crypto ethos of an open system free from a centralized authority. The question remains, whether the second-order effects are temporary or permanent.