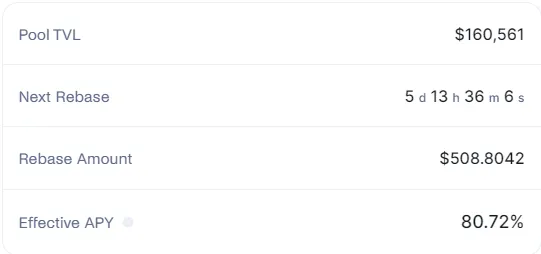

On-chain yields are surging right now. Ethena’s USDe offers anywhere from 25-60% yield by tokenizing funding rates. Banana Gun offers 30-80% yield through BANANA dividends (idiosyncratic risk involved here). Synthetix, GMX, and Gains Network are proven yield vehicles supporting low double-digit real yields. USDC lending rates across Solana and Ethereum are currently around 20-25%. And now we have Anzen, currently offering 80.72% yield on stables.

Anzen is bringing a fresh take on RWA DeFi and has some lucrative yields early on. Anzen brings private credit investments on chain through 3 layers:

1: Permissioned investment in private credit (issuance and redemption of private credit token – sPCT) by accredited, KYC-ed investors. Same playbook as USDC, Backed, Ondo, etc, open to non-US investors.

2: Permissionless exposure to private credit via PCT. Users deposit USDC and can mint PCT, a rebasing token backed 1:1 by RWA via sPCT. 90% of sPCT yield is passed through to PCT via periodic rebases.

3: Composability in DeFi via wPCT. Wrapping PCT allows it to be used in DeFi without rebase complications, analogous to weETH or wstETH.

The permissionless PCT component can be thought of as a liquidity pool funded loan collateralized by the sPCT RWA investments. This is similar to how Flux Finance works with Ondo Finance. I’m more excited about Anzen than Flux for several reasons. Treasury yields are typically rather low, and the passthrough spread not only hits harder, but will undermine a lot of the utility. Onboarding treasuries to DeFi is exciting because of the endless possibilities for composability for such a fundamental aspect of financial markets. The passthrough spread makes the yield less attractive, and the on-chain token less representative of the underlying and therefore less relevant in the long term. For US treasuries, Backed Finance and Superstate have the right idea, in my opinion.

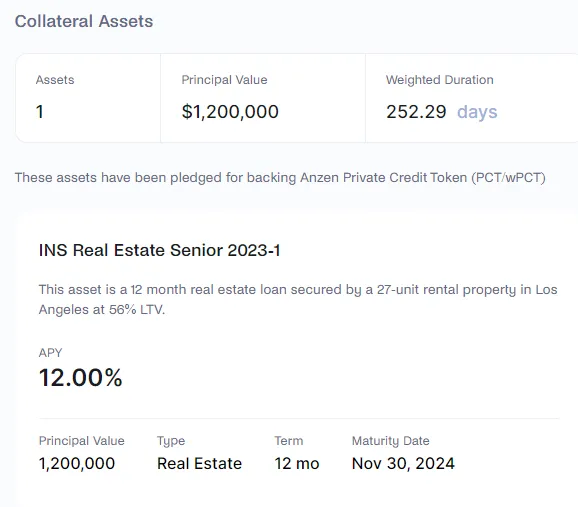

By using private credit instruments, Anzen is working with much higher yield, often 10-17%. This gives more breathing room for the yield to remain attractive in falling rate environments. Private credit tokens are also less valueable as a tracker of the instrument itself. What’s important with Anzen is that it offers permissionless, composable, and attractive real word yield, not that it tracks a certain index or product.

Anzen currently has one collateral asset, a $1.2M real estate loan at 12% APY secured by a 27-unit rental property in Los Angeles. With $144K of estimated annual yield (90% = $129.6K pass through) and only $160K of TVL, current depositors are currently enjoying over 80% APY. Sure, with only $160K TVL, this yield will quickly compress as TVL increases. But Anzen will begin to onboard more investments and can scale the operation through this flywheel. Even at it’s soft floor of 90% of the collateral investment bucket (likely 9-10%+) this could be sustainable and attractive source of yield for a long time.

Eventually, much of the operational responsibility will be offloaded to the DAO, and Anzen does not yet have a token. It’s early for Anzen, stay tuned for a more detailed update as things progress. In the DeFi year ahead report, we discussed our thesis about the RWA design space beginning to open up, and this is certainly an example. As RWAs break out of the permissioned box they’ve been confined to and explore more creative DeFi implementations, they may finally be embraced by the crypto community.