Are high ETH fees on Ethereum bullish or bearish? Anytime someone asks this question you get the usual troll response “Ethereum is too expensive, nobody goes there anymore” and while true, I think it’s worthwhile to dissect this point of view instead of lazily dismissing it outright.

We should start as to why ETH fees are so expensive: it’s the main game in town. Ethereum has been the only network to create sustained demand for its blockspace, the only blockchain today that generates a significant amount of fee revenue. In an industry where fundamental economic value is far and few between, it’s hard to see that as anything but extremely bullish.

Ethereum is also where all of the money is. Why don’t the high value NFTs or memecoins launch on L2s? Well, there’s simply not as much money to be made there. This is why devs continue to launch on L1 despite the fees. If people think they can generate return multiples, then the fees are just the cost of access to that opportunity. Ethereum is where most of the magic happens.

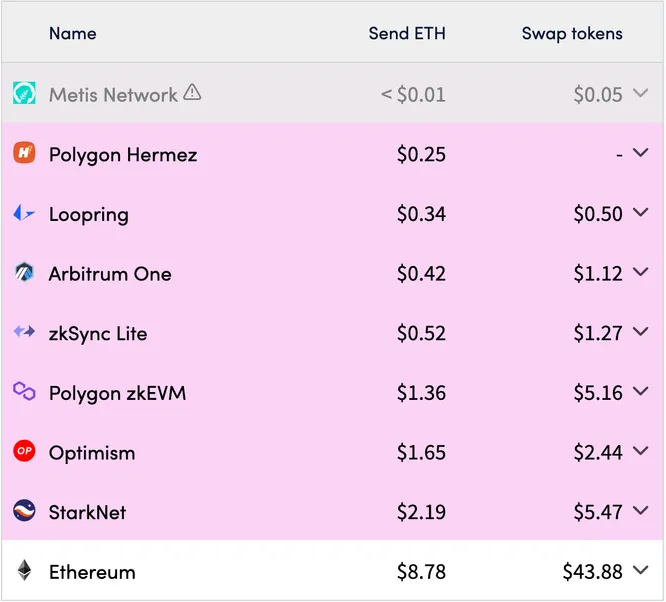

But the question raised shouldn’t be totally dismissed because of the state of the industry today. When fees rise on L1 it impacts everything built on top, including L2s. Even right now, doing simple swaps on L2’s is >$1. Is this ok for majority of use cases? Probably, especially if transactions are infrequent. Is it ok for CLOB’s, high frequency trading, or any other high throughput activity where transactions need to be placed on the order of not just seconds, but milliseconds? No.

EIP-4844 is coming, and it will help. The introduction of a new fee market is estimated to reduce rollup fees by ~10x. But even still, those high-throughput use cases still cannot be paying on the order of magnitude of $0.10-0.20 fees. Take a CLOB. MM’s are often placing and cancelling orders every block, and for a CLOB you need sub-second block times. Let’s use 500ms as an example: with $0.10 fees, to place/cancel an order every block would be 172.8k tx’s/day for a single mm on a single market. With $0.10 fees this would cost $17,280/day, just for the privilege of placing orders. In the long-run Ethereum will add more DA throughput with danksharding but the point remains, with any meaningful amount of activity, especially when we get into a bull-market, use cases will be priced out.

With Celestia rollups, things like Polygon Avail, Solana, appchains and more, rollups on Ethereum will need to compete with these alternatives that are nearly guaranteed to be cheaper. Will it matter? As I said, for some stuff no, but for others surely yes. There is only so much activity that can rollup to or happen on Ethereum for at least the next few years (and even in the long run).

So what’s the risk to Ethereum? For L1, and again I need to reiterate this point, not much. But for the rollups? People will have more options, and there will be more competition for users. Ethereum will keep the whales, and it’s hard to see most of the high value transactions move away from Ethereum. It’s the longest standing, globally neutral, self-sustaining place to settle high value transactions. But will the vision of a crypto future where Ethereum is the only “settlement layer” with thousands of rollups on-top be the end state? Removing other factors like full-stack customization, sovereignty, etc, if just looking at the cost to transact the answer is most likely no.

So anyways, back to the original question. Are high fees bullish or bearish?

Yes.