Earlier this week, Arweave launched AO, a “hyper parallel computer.” Many are now calling Arweave a “new Layer 1.” It’s a long-standing narrative, but this latest announcement is worth paying attention to. At the very least, because of the price action.

In the 24 hours following the AO announcement, the price of $AR put in a 2x. It’s since pulled back a bit, but CT has stayed buzzing about its potential.

ao’s programming model is very elegant

all system messages are signed & saved in one place so all network participants can verify what’s real, agree on a canonical state, and continue advancing the state machine with new messages semi-independently ♻️

really impressive work https://t.co/xO0Bm1S2RO

— Eddy Lazzarin 🟠🔭 (@eddylazzarin) February 29, 2024

Outside the intro video above, the docs are relatively light and information is hard to come by on AO. But from what the Arweave team has said, AO’s core innovation is the ability to scale blockchain state horizontally. Instead of scaling vertically via L2s and L3s, AO aims to scale horizontally by parallelizing operations across an “arbitrary number of processes.”

This is a pretty big claim, and it remains to be seen whether all this modular, parallel processing has any big UX/composability tradeoffs. But if what the Arweave team says is true, then AO could be a fundamentally new design space for computation that was previously impossible on more constrained state machines like Ethereum and Solana. There’s even a nascent “onchain LLMs are now possible” narrative brewing…

I’d say I am cautiously optimistic for now, mostly because AO seems to enable new applications like AMMs and DAI-like stablecoin minting that previously were impossible on yesterday’s Arweave network. Whether this new design space will make Arweave competitive with the likes of Ethereum and Solana remains to be seen, but it makes sense that it is driving AR’s current price action.

Incredible day for the Arweave ecosystem.

Today, we announced Bark (https://t.co/2G17Ax7Mjf) and @AstroUSD as the first AMM *and* stablecoin on @aoTheComputer 🚀 pic.twitter.com/RYZEFzwL2R

— t8.arweave.dev (@TateBerenbaum) February 28, 2024

Outside of AO, Arweave – the storage network – is seeing remarkable growth.

3 billion transactions. Congratulations! 🥳🥳🥳

0 -> 1b: 1,868 days.

1b -> 2b: 153 days.

2b -> 3b: 55 days.Even cooler: Users pay literally zero fees on top of base storage costs. And never will.

Coolest: Endowment contributions alone make Arweave sporadically deflationary. pic.twitter.com/nnYlmFqaDf

— 🐘🔗 sam.arweave.dev (@samecwilliams) February 13, 2024

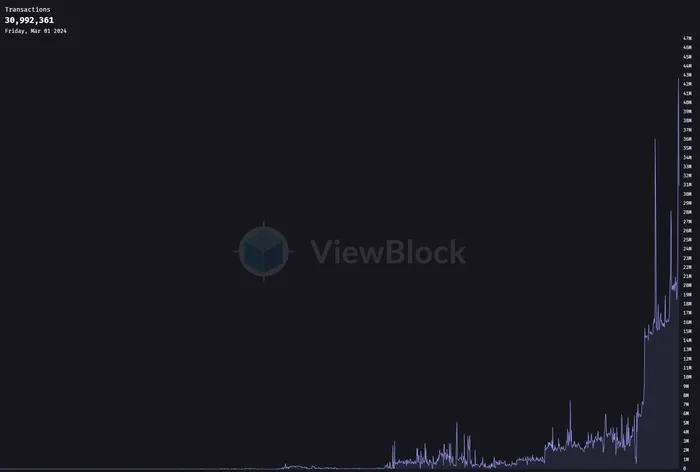

Transactions per day are going vertical and approaching 50M/daily.

Rising transactions are driving data fees, which on several occasions has pushed Arweave “deflationary.” Although AR supply isn’t technically burned — it instead goes to an endowment fund used to reward miners — AR is removed from circulation for 100s of years (literally, lol). So, it is functionally the same dynamic as a plain vanilla burn mechanism.

See the attached chart? Arweave being deflationary. How, you ask?

Data Fees > Block Rewards.

Over 95% of Tx fees go to the endowment, essentially removing $AR tokens from circulation. NFA.

Ps. Are you going to the event this week? Compute on Arweave: https://t.co/ohZ06PaSL5 pic.twitter.com/nm12trCA7V

— Only Arweave (@onlyarweave) February 26, 2024

As more info comes out and builders start building, I will share what I learn here. In the meantime, let me know what you think about Arweave and AO in the comments below — especially if you’ve found any good resources on AO’s tech.