Base has emerged as a resilient contender, swiftly rebounding from its previous challenges marked by the BALD episode and now riding the momentum created by friend.tech. Notably, the daily transactions on Base now outpace Layer 2 giants like Arbitrum and Optimism.

Source: Twitter (@DeFiyst)

However, one must approach this with a discerning eye: as some have noted that bots on friend.tech could be skewing these numbers, inflating transaction counts. The most profitable bot generated 132K transactions in just 13 hours.

Diving deeper into Base’s metrics, its TVL has surged this month, reaching a commendable ~$190M, of which only a sliver ($7.2M) can be attributed to friend.tech. This growth is attributed to DeFi protocols on Base, ushering in attractive yield farming opportunities. The lion’s share of this TVL is held by two decentralized exchanges, BaseSwap and SwapBased, boasting $56M and $20M, respectively.

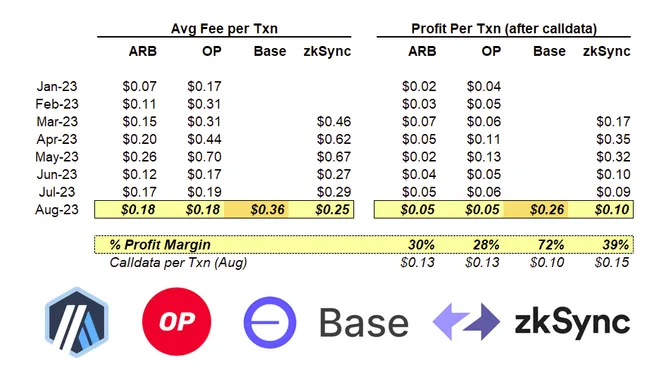

From a profitability standpoint, Base is carving out an enviable niche for itself. The platform has generated profits to the tune of $1.72M this month, eclipsing the combined profits of both Arbitrum and Optimism. This outperformance is due to Base’s profit margin of 67%, starkly higher than Arbitrum’s 33% and Optimism’s 30%.

Source: Twitter (@jamesjho_)

The rationale? Base commands a higher average transaction fee, a strategy that might continue to pay off, given its relationship with Coinbase. By leveraging this to transition CEX users directly to Base, they could sustain these premium fees. While the revenue implications might be modest at present, it’s an aspect investors should monitor, especially in relation to Coinbase’s earnings.