Bitcoin has had a lot of narratives in its short history: internet cash, hard money, inflation hedge, uncensorable money, the truth chain, and many more. This upcoming cycle is no different – with bullish price action, new narratives will emerge. It’s hard to predict the exact narratives that will pop up, but there is already one that I feel the need to add some context around.

The existing world order is beginning to fray. The USA, long the only superpower and the de facto leader of the world for the last 30 years, is facing some challenges to its power. A growing Russia, a more belligerent Iran, an emerging China, a group of nations banding together under BRICS, and a high debt load are just a few of the challenges growing at the empire’s border. For the first time since the fall of the Berlin Wall, the national order looks to be changing. As Lenin said: “There are decades where nothing happens, and there are weeks where decades happen,” and we are in those weeks.

Always the opportunists, some accounts on Twitter are attempting to create the narratives that Bitcoin is now a strategically important asset or some sort of macro hedge. The narrative seems to have two aspects: the nation-based strategic commodity and the individual macro hedge.

Bitcoin As Strategic Commodity

Source: Here

I hate the idea of Bitcoin as a strategic commodity, as it fundamentally misunderstands why commodities matter. The narrative of Bitcoin as a strategic commodity revolves around the idea that as Bitcoin is an uncensorable neutral network, nations will begin accumulating BTC as a monetary asset to trade, a hard asset to back its currency, or because it is secure against other nation-states.

There are so many problems with this narrative. Commodities are essential as strategic assets because industries need them to make war materials or other goods. Nations want chromium because they need it for stainless steel (i.e. gun barrels) and wheat because people eat it. As far as I know, nations have yet to figure out how to convert BTC into war material, and no one exists on a diet of OpenDimes. Countries want commodities because, at the end of the day, they can use them to make things.

Also, the logic around money and finance change drastically during wartime. Nations suspend monetary standards; Lincoln suspended the gold standard with Greenbacks in the Civil War so they could spend more. Nations seize assets, like the West taking Russian assets or Ukraine seizing oil for the war. Nations suspend free markets to force industries to focus on war materials or needed goods; tractor factories quickly turn into tank factories. Finance matters less in wartime; commodities matter most. And Bitcoin is a financial asset through and through.

Bitcoin is also not yet secure enough to be useful for international affairs. Bitcoin is, without a doubt, the most secure open network probably to ever exist. But it is not secure enough to survive the malicious intention of even some of the weakest states. Many will point to the hashrate as a level of Bitcoins security, but nations can seize ASICs, they can blacklist addresses, hit off/onramps, etc. And no nation will rely on Bitcoin if an unfriendly one can lean on it anyway – imagine a nation conducts a vast trade deal with BTC, only to see the transaction censored or reverted by miners under pressure to do so by their local government.

Bitcoin <> BRICs

Source: Here

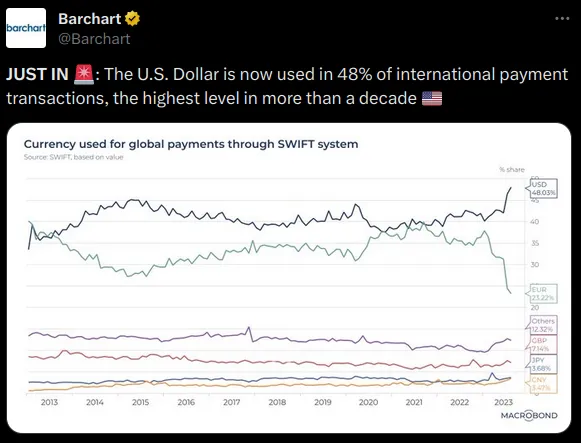

Because Bitcoin is still relatively insecure to nation-state attention, Bitcoin is unsuitable for BRICS. BRICS is a rough bloc of nations emerging as a separate geopolitical pole from the American-dominated one. There was a lot of chatter on Bitcoin Twitter about how the BRICS nations could adopt Bitcoin as a settlement currency. But because the USA still has a lot of hash power and Bitcoin is still insecure from nation-state attention, there is almost no chance Bitcoin will play a significant part in the financial infrastructure of BRICS nations. BRICS even has yet to make a considerable dent in DXY trade, and the dollar is still the king of currencies. Bitcoin is an important financial asset. However, it is not yet an essential strategic asset.

Bitcoin As Individual Macro Hedge

The idea of Bitcoin as an individual hedge against macro events carries more water than Bitcoin as a strategic commodity, but it still has a lot of shortcomings:

- Bitcoin has a glaring threat vector – you need connectivity to use it. If a conflict gets dire – nuclear weapons, information control, etc – you can expect your connectivity and ability to use Bitcoin to disappear.

- Bitcoin is still easy to seize. Suppose nations are threatened by their citizens using Bitcoin. In that case, AML and KYC databases are readily available, and CEXs will hand those over if asked. Without privacy, Bitcoin is seizable.

- The ‘boating accident’ meme fails as nations can easily watch the addresses – effectively freezing them forever.

- Geographically dispersed seed phrases are useless if war hampers air travel.

Bitcoin is a hard asset – they aren’t making more of it. But as an asset to secure oneself against future conflicts and catastrophic world events, you’re better off buying bullets, water purification tablets, and maybe some shiny metals.

Narrative Chairs

I love Bitcoin; it is a technical marvel. Bitcoin is future optimism made manifest and one of the most promising technologies to emerge in the past decade. But the narratives around it are often so far disconnected from reality that they are fantasy. And the idea that Bitcoin is an excellent macro hedge or national strategic asset is just that, fantasy. Bitcoin could be these things at some point in the future, but it’s not ready yet. Beyond regulators making some rules around it and large institutions figuring out ways to make fees off it, it’s barely on the radar of national decision-makers.

Of course, one doesn’t need to believe in a narrative to benefit from it. Narratives are a meme, spread like wildfire and can drive price action. If enough people believe a narrative, it becomes self-reinforcing – at least until people wake up to the reality of it. As such, one could play the narrative trade here but try not to get caught; Bitcoin is awesome, but it’s not yet at the level of nation-state importance. Bitcoin may get there, but I would be surprised if it happened within the next two decades.

Bitcoin will probably benefit from a more conflictual world. But probably due to lower rates and increased liquidity rather than it becoming a strategically important asset. So, just be aware that Bitcoin is not yet ready for the big leagues, and remain skeptical when this narrative starts going.