A quick recap on how BLUR conducted their airdrop, in short it was rolled out (strategically) in 3 phases:

Aidrop 1: Users that traded NFTs over the past 6 months from Blur’s launch in October 2022

Airdrop 2: Airdropped to users who actively listed on Blur

Airdrop 3: Airdropped to users who placed bids on Blur (Introduced Bid points which incentivised liquidity)

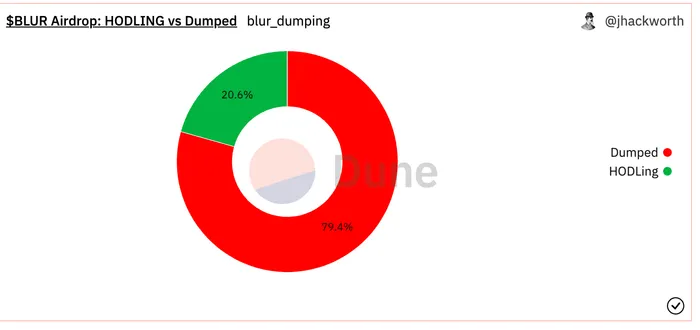

With the BLUR airdrop on Valentines day, what did airdrop holders do? As of Feb 28, ~80% of airdrop participants have sold their tokens, with 20% still holding on to the initial airdrop. In total, 360M BLUR tokens were distributed (representing 12% of total token supply). Thus, it is highly likely that users who wanted to sell their tokens have already sold and the remaining 20% of users who held on to their airdrops are planning to hold the token over a longer timeframe.

Is it a good time to accumulate BLUR now that the initial airdrop selling pressure is gone? Probably not. With season 2, the team announced an additional 300M+ BLUR tokens allocated for the community, which will increase the circulating token supply by nearly 2x. Further, team/investor/advisor allocation will also start to unlock starting in June, increasing the selling pressure for BLUR. Approximately ~1B tokens will be in circulating supply before the end of the year, so the selling pressure for BLUR is likely high this year.

Despite this, Blur is currently dominating the NFT market by volume share with 76.5% of NFT trading volume on Feb 27. OpenSea is in second place at 19.2%. While Blur’s current volume market dominance is a result of incentivization from BLUR tokens and is likely inflated, there is no denying that Blur is stealing market share away from OpenSea and putting pressure on the incumbent. Is this a tale of David vs Goliath, or will volume and liquidity depth dry up once incentives end? No one knows for sure in web3 context, where network effects can be broken down as a result of rewards and incentives. We will continue to monitor this segment as the competition stiffens.