Given the chaotic market events stemming from last week’s banking crisis, we would be expecting crypto markets to be trading much lower this week right? Last weekend, peak fear began to take hold as the amount of assets backing USDC held in failing banks was still largely unknown, and there was indeed an outside probability of bank failure/no bailout (certainly not the base-case, but one that needed to be factored in nonetheless). As the weekend progressed, it became clear that the FDIC would take measures to protect all depositors, insured or uninsured, leading to the veil of uncertainty being lifted. Crypto markets began to surge.

And surge they did, with BTC leading the way. BTC finds itself retracing the entirety of the banking crisis/USDC-fud move lower, and is now looking to traverse the low volume gap that we have been observing for the better part of the last year. $28K-$30K is looking more and more like a magnet. Interestingly, this has been the first time in over a year in which we have seen such a strong structural divergence between BTC and legacy markets.

It is important to note that this rally has largely been led by BTC. In fact, year to date BTC leads comps at +57.1% versus ETH (+47.8%), DeFi Index (51.3%), and SPX (+1.3%). Zooming into the recent banking crisis, we can see the relative strength across these assets, with BTC again leading the charge out of the local lows. BTC has moved to new yearly highs, breaking above the previous levels set back in February. We have yet to see this same thing occur on ETH and other altcoins, which is a testament to BTC’s relative strength at the moment.

So given the banking crisis plaguing traditional markets, the apparent de-banking of crypto institutions in the United States with the closures of SVB and SB, and the re-emergence of issues related to crypto’s reliance on centralized stablecoins, and by extension traditional finance (ex. DeFi)… why is crypto rallying, and why is BTC so strong?

As it became clear that SVB was indeed the first banking victim, crypto participants were faced with some serious decisions. As we know, the extent of SVB/USDC situation was largely unclear at the time, so how were crypto participants to safeguard their assets in the event of bad-to-worst case scenarios? There were a few options:

- Swap USDC to another stablecoin like USDT, and take the haircut due to the USDC depeg at the time, while assuming the risks associated with the chosen stablecoin.

- Assume market risk by purchasing spot crypto assets, like spot BTC or spot ETH.

- Create a synthetic stable position by posting spot BTC collateral and shorting the equivalent notional amount (1:1 spot long/perp short) on a BTCPERP vehicle. Obviously funding rates can be a cost here, but that is the cost of doing business. This involves some degree of counterparty risk as well.

- Exit the system all together.

Most crypto participants probably are not doing option 4 if they haven’t already (having experienced LUNA/UST, 3AC liquidation, and the FTX fraud). Option 1 has no real buy/sell pressure effects on the market. And the remaining two options result in spot buying of crypto assets.

From a pure markets analysis perspective, this rally also makes sense. Similar to the arguments for de-risking into the $25K region (obvious take-profit region at range highs, obvious hedge region, and obvious shorting region for traders), the opposite became true on the retest of the 2017 ATH/$20K region.

- Obvious area for risk appetite to return (range lows)

- Liquidation of most long positions built up in the prior several weeks

- Funding environment becoming attractive at support region

- Tailwinds of USDC uncertainty being lifted/structural buying pressure as a result

We have seen prices rally considerably, sweeping the multi-month range highs at $25K. OI levels have returned to levels seen prior to the banking crisis, with a renewed spot bid to boot. As always, we are in a high timeframe resistance area until prices accept and hold above $25K. Even so, the low volume gap above is beginning to look like a realistic target should prices continue to rally. In the event that we break out of this range, $28K-$30K will likely come into play in a big way.

Given the exposure of DeFi/ETH to USDC and the potential implications, it isn’t so surprising that the BTC narrative is beginning to take hold once again.

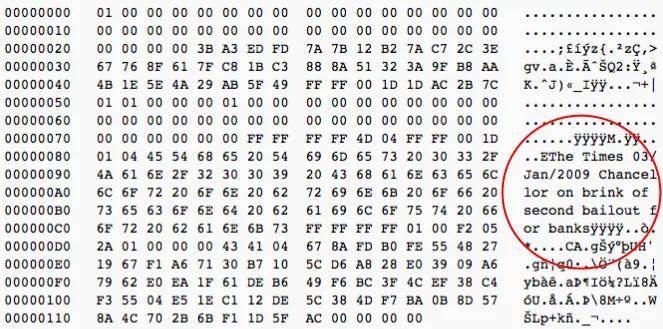

BTC Genesis Block: Raw Hex Version

Perhaps it is time that we return to our roots a bit?

Regardless of how strong markets look, it is important to remember that we are at the mercy of much larger forces at play. It is important to remain objective and balance the strength of these short term price movements with the bigger picture, which remains unclear and uncertain at best. As prices move higher towards supply/resistance areas, and as we draw closer to the March FOMC meeting, caution is likely warranted.