This guy makes some good points, but I have a few things to add. While there appears to be a clear trend, I‘d argue not much has changed, just the meta. More analysis needs to be made and variables controlled for to draw conclusions. A few important rules:

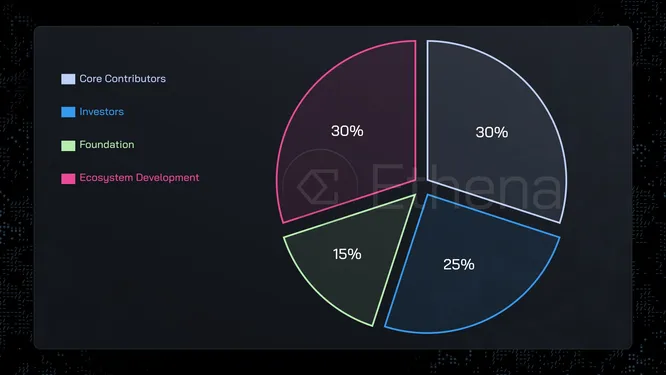

Foundation tokens should be considered team tokens by default. Applying this adjustment to Ethena’s ENA token, for example, results in 45% team tokens and 70% insiders.

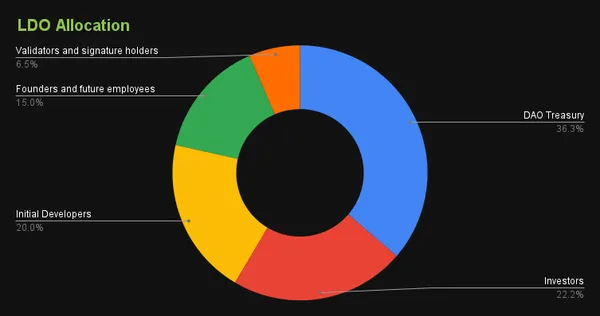

Massive allocations to an ambiguous DAO treasury has been historically popular, and it disguises large team allocations.

When considering that DAO treasury tokens are controlled by governance, and governance moves very slow, is controlled by insiders, and often has little plan for the use of DAO tokens, these should be removed from the distribution for proper context. In the case of LDO, removing the DAO treasury token allocation significantly bumps the team and insider allocations:

100% – 36.3% = 63.7% total allo

35% / 63.7% = 55% Team

(35 + 22.2) / 63.7 = 90% Insiders

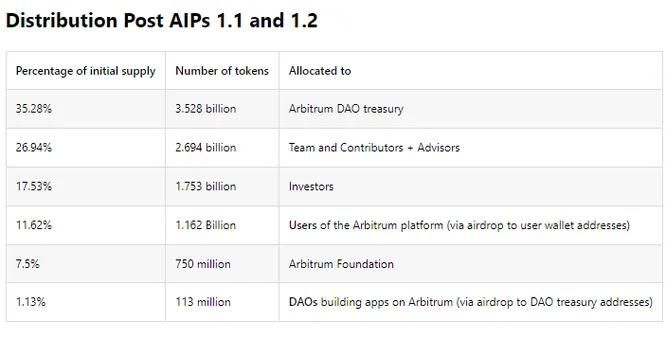

Arbitrum ARB is a great example of a token that needs several adjustments. After lumping foundation tokens into team tokens and eliminating the treasury allocation, the effective distribution arrives at a similar range to Lido.

34.44 / (100-35.25) = 53% Team, 80% Insiders

Importantly, the Arbitrum DAO treasury allocation has been far more tangible than most. STIP and LTIPP programs have distributed treasury tokens to ecosystem projects and their users, well in advance of the first big insider unlocks. In Arbitrum’s case, the treasury tokens don’t need to be eliminated.

After incorporating these variables, surrounding tokens insider allocations are likely boosted across the board. Comparatively, ENA’s allocation is par for the course and refreshingly straightforward to interpret.

When auditing token distributions, make sure to consider the presence of a foundation and a treasury (and the potential use/plan for these funds). After controlling for these, I pay most attention to the community vs insider split and the insider unlock schedule. A small insider allocation with an immediate 6 month linear vest is far more bearish than a predatory allocation with long lockups.