Finally, after what has felt like decades of rate hikes, there seems to be some evidence that the economy is starting to slow and open the way for rate cuts. I have personally spent the last few months relatively flat. Crypto markets behave exactly like risk markets, struggling with high rates and declining liquidity. I have tried to play a few bounces, but I am mostly waiting for a better macro environment to start scaling back in – limiting downside has been my goal. One of the biggest signals for me to begin scaling back into crypto markets is some economic weakness, as central banks need to see it before rate cuts.

As readers know, central banks worldwide will maintain high rates if the economy is strong. Despite rates being significantly high, economies worldwide have been remarkably resilient – unemployment, in particular, has remained low. Not only that, but consumer spending and asset prices have remained elevated. The economy needs to signal some weakness for rate cuts before central banks do anything drastic. And, for the first time in a while, things look like they may start weakening.

Doom Stats

People can watch hundreds, if not thousands, of metrics for economic weakness. I have been watching a few that seem to signal some weakness.

The first thing I watch is the price of copper. Copper is the industrial metal. Modern society uses copper in everything – electronics, bullets, cars, jet skis, wiring, and more. If it’s a modern consumer good, it probably has copper. As such, the price of copper is a good barometer for the health of economies. Elevated copper prices signal economies full of consumption and manufacturing, while suppressed copper prices signal weakness. Copper is up significantly from 5 years ago – from a low of $2.19 during the Covid crash of 2020 to $3.65 now, the price of copper is nearly double. But, year to date, copper is down from $3.92 to $3.65. Copper looks like it is starting to show some weakness, which could signal a broader downtrend. However, the price of copper is also affected by supply chains, and with the growing fractures in the international order, copper prices could be volatile. The weakening in copper prices seems to signal some general economic weakness, but it is too early to tell.

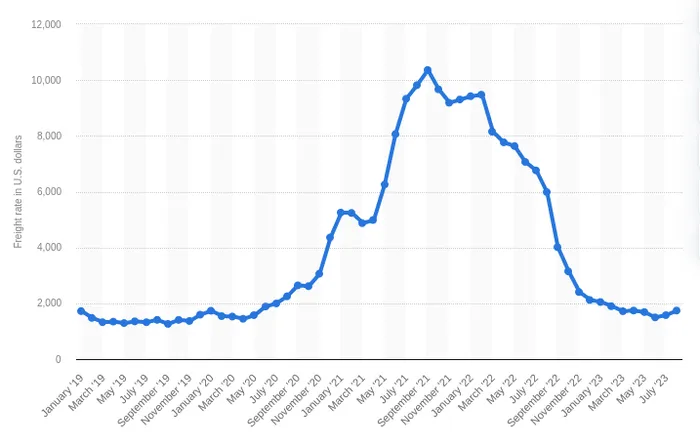

The other one I follow closely is container shipping rates. So, we live in a globalized world – at least for now. If people like Zeihan are correct, then the world is deglobalizing, but for now, it’s globalized. Container shipping prices in a globalized world are an essential metric for measuring the health of economies. Chances are, most things you use have spent time in a shipping container. Shipping containers are the copper of the trading world. If economies are healthy and demand for consumer goods is high, container rates will be more expensive, and companies move goods around to meet demand. If rates are low, then generally, demand is lower. That said, when using this metric, you must account for inventories. Companies stocked up on the list during COVID-19, so there is still demand for goods, but container rates have fallen.

So, what are we seeing in container rates? In a word, plummeting. Since 2022, container shipping rates have cratered by 82%. The decline in shipping rates is most likely due to overstocked inventories and plunging demand for goods in weakening economies. Based on these rates alone, economies are weakening as consumers reign in their spending due to various factors.

The third one I like to follow is debt. To me, consumption without massive increases in debt signals a strong economy. Suppose consumption runs hand in hand with increasing credit card debt. In that case, it tells me that consumption and the economy will hit a brick wall as people eventually hit their debt limits – especially with rising rates. On that note, the data out of the USA is a bit shocking. Credit card debt just topped out at over $1T for the first time, with 47% of people carrying balances over month to month. Debt consumer spending is buoying the economy, and at some point, consumer spending will stop. As people service higher debt loads at higher interest rates, spending should decline, which weakens the economy.

Fuzzy Anecdotes

I follow the preceding hard metrics and look for more anecdotal and fuzzy indicators. From living in boom towns, two I learned to watch are new construction and toys. Construction is simple. In my day to day, I keep an eye out for construction projects. Many areas where I have lived experience wild swings in constructions based on single asset prices like lumber, coal, oil, gas, and nickel. If there are few construction projects around me due to depressed prices, it tells me things are weak.

The second anecdotal thing I look for, and my favorite, is toys. By toys, I mean any sizeable non-essential purchase used for recreation. In my area, people love toys. The toys I see include $600K fishing boats, $40Kn UTVs, $80K trailers, $5K skis, $15K mountain bikes, sports cars, horses, etc. These toys are not things people need, are often bought on credit, and are the first to go for sale when things start to go south. I check classified websites and local dealerships and look for where prices are at. I know things are weak if I see an uptick in inventory and many people trying to sell their toys quickly by slashing prices. Of course, I try to analyze both things through a broader lens to assess if the phenomena are caused by something local or caused by larger forces. But regardless, I always keep my eye out for things like this. And at least in my area, I see many toys for sale.

Non-Exhaustive

This list of things is in no way exhaustive. There are a million different ways to measure the health of an economy. These are just a few things I have watched as I wait to scale back into crypto markets. It is weird to say aloud, but the bleaker things look, the better they look for markets. If economies weaken, central banks will feel comfortable lowering rates and potentially increasing liquidity through injections or other tools. As crypto is currently a risk asset, they will stand to benefit when the macro changes – and it seems like the economy is starting to weaken across a few metrics. It is still pretty early, but if you’re banking on rate cuts from a weakening economy, things seem to be heading that way.