CoW Swap debuted their new “LVR Aware” AMM. If AMMs are to succeed long-term, getting these types of designs correct will be critical.

Today, vanilla/plain AMMs lose a lot of money to LVR. You can also think of this as “CEX-DEX arbitrage”. When a price changes on a CEX, arbers compete to adjust prices on AMMs. While AMM LPs get fees, they sell at unfavorable prices along the curve. For eg, If ETH is $2k on an AMM and CEX, and then goes to $2.1k on a CEX, the AMM should be aware of that and reprice ETH in the AMM to $2.1k. Instead, dumb/vanilla AMMs sell ETH on the curve from $2k to $2.1k as searchers arb it.

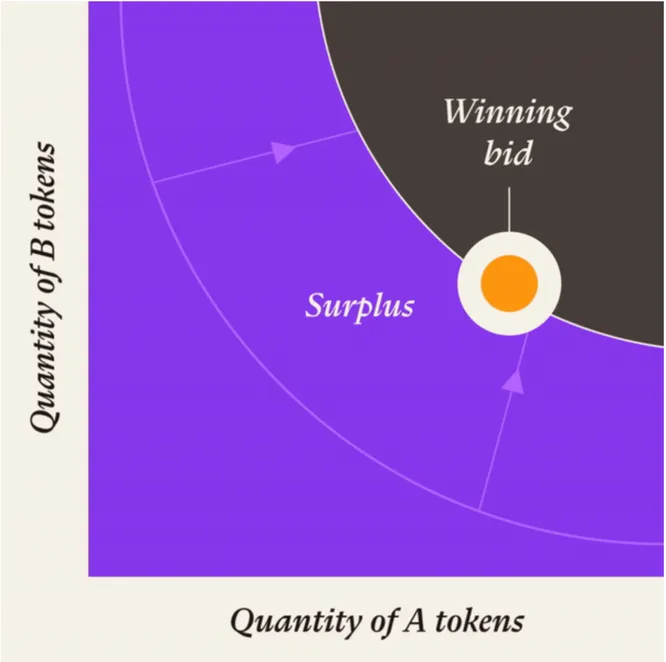

The CoW AMM is aware. Essentially, solvers will bid to rebalance the CoW AMM. If they know there is a “free” $100 to extract like in the example above, they will bid close to this number, whose value goes back to LPs.

Expect to see many more of these “LVR/MEV Aware” AMM designs over the coming years. CoW Swap was first to intent trading, and they’re first (in Ethereum eco as Skip was first in Cosmos) to designing an LVR Aware AMM. Full article here: https://blog.cow.fi/cow-dao-launches-the-first-mev-capturing-amm-bc7199e217a3