Inflation slowed for the 10th consecutive month, with CPI coming in at roughly 4.9%, slightly lower than the 5.0% expectations. Core CPI came in at roughly 5.5%, matching expectations.

While we are seeing CPI continue to soften, it is worth noting that 5% inflation is still extremely elevated, and unacceptable with what we’ve been conditioned to expect in the United States. In addition, we are not seeing Core CPI come in at the same rate as CPI.

As noted in the tweet, with the labor market remaining strong, corporate earnings surprising to the upside, and inflation still at unacceptable levels, a June rate hike cannot be ruled out.

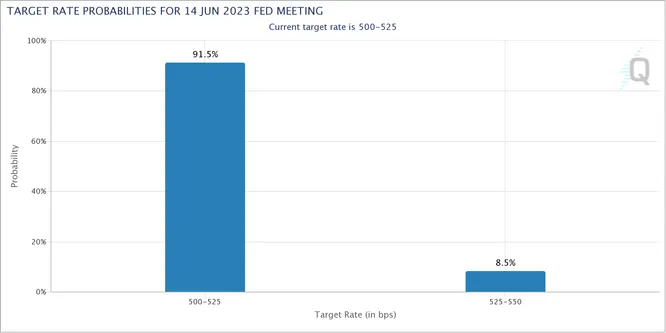

At present, the market is pricing in >90% chance of no rate hike. This will be interesting to watch over the next several weeks. Attention will now shift once again toward the June FOMC meeting, with Powell in the hotseat once more.