In the previous cycle, coins on Solana, colloquially called Sam coins, referred to tokens that had a very low float and by extension, an absurd fully diluted valuation.

Most, if not all, of these tokens went down 90% and then another 90%, as market participants gradually started realizing the level of dilution that was about to happen.

But this playbook was widely adopted. Projects would launch their token with a low circulating supply. And as most participants don’t even concern themselves with FDV, buy these tokens, thus sending their valuation to extremes.

Naturally, these valuations are unsustainable which results in a death spiral for the token’s PA and subsequently the project itself.

Now with pleasantries out of the way, let’s dive into the heart of the matter.

The token generation event or TGE of WorldCoin (WLD) was in July. 2023.

The team behind WLD is OpenAI, led by Sam Altman.

At launch, the circulating supply was capped at 143M WLD, out of which 43M were reserved for early users, and the remaining 100M were loaned out to five market makers. The token float is absurdly low, seeing how the total supply is 10B WLD. So, although the project is led by a different Sam, the playbook they adopted was inspired by SBF.

The launch price was around $2, giving WLD a circulating market cap of $285M and an FDV of $20B. 90% of the supply was in the hands of the market makers, and their contract had a clause that allowed them to buy back the tokens from the foundation at the strike price. For example, if the strike price is $2, and during the tenure of the contract the price of WLD is between $2.5-$3, the market makers had every incentive to sell their inventory as they could always trade the tokens with the foundation at $2.

Essentially, it was free money for them, as reflected in the initial price action.

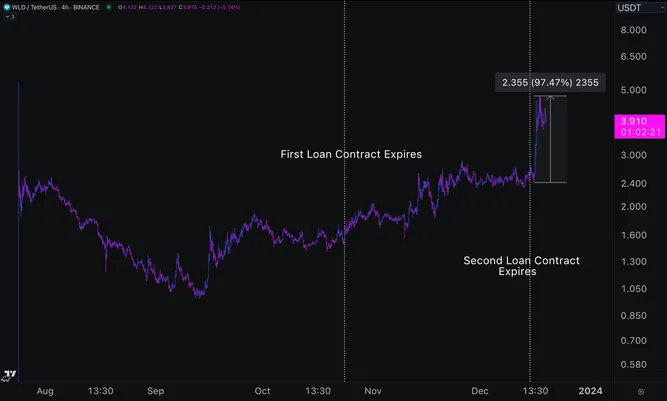

The second loan contract was to be implemented on 24th Oct. 2023 and required the market makers to return 25M WLD, as the new contract was only for 75M tokens as opposed to 100M. The price action leading into the expiry suggests that these market makers had to buy back these tokens to return them to the foundation.

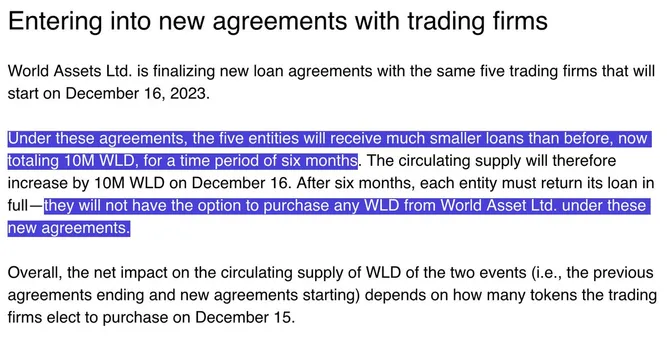

The terms of the second deal were pretty much the same. The second contract expired on the 15th Dec. 2023. The latest contract is quite different.

The loan amount has been reduced to just 10M WLD and the option to purchase WLD from the foundation has been removed. So, not only do the market makers have no incentive to suppress the price any longer, but the circulating supply has also reduced considerably and has settled around 100M WLD. The market makers no longer have any incentive to suppress the price and given that they only have 10M tokens, probably can’t do it either.

As the market realized this, the price of WLD increased by roughly 100% in a couple of days. Even with this increase, its market cap is about $400M. This is quite low when you compare it to other AI projects such as FET, AGIX, RNDR, etc.

Sure, the FDV is huge and although FDV does matter in the long run, it holds little significance in short-term momentum-driven trades.

Filecoin once had an FDV of $250B but it just kept going up. Market participants who put too much weight on FDV in the short term tend to short these moves, but the price keeps moving up which forces them to rebuy at a higher price thus pushing prices even higher.

Tokens with a low float can be moved any which way one wants, so it shouldn’t surprise us if we find WLD trading at $10 soon, with an FDV of $100B.