Token airdrops are one of the most celebrated events in the crypto space, and for good reason: they reward users (and Sybil attackers) for their usage/promotion of the platform. After Arbitrum’s airdrop in Q1 2023, ARKM is perhaps the most notable one. That said, let’s dive into some analytics to try and unearth what’s happening behind the scenes.

In terms of the distribution of airdropped tokens, it comes as no surprise that the majority of the recipients belong to the lowest bracket. This is pretty consistent with what we have seen with prior airdrops all the way back to Uniswap’s airdrop.

But what’s more insightful is what the recipients have done with their airdropped tokens.

In that regard, about 95% of the recipients have reduced their holdings by way of either transferring to centralized exchanges or selling them on-chain. Also, it is relatively safe to assume that the transferred tokens are most likely sold. This behavior is not that consistent with prior airdrops, at least not in terms of the speed of reduction. For the curious who’d like to compare stats, please refer to our Pro report on the breakdown of airdrops and associated activities by clicking here.

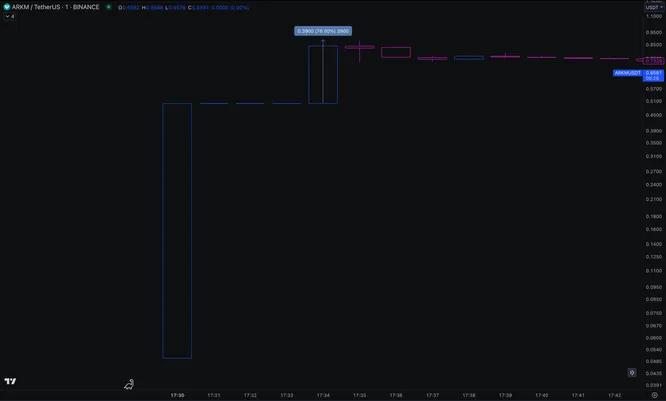

Lastly, in terms of price action, we had something new to deal with. Unlike their prior launchpad listings, Binance, this time around, announced that they would instate a price ceiling mechanism whereby the price would be capped at 10X the IEO price for the first five minutes. The rationale behind this was that it would help protect the users. But did it? Not really.

It spun off a lot of game theory which materialized by large limit orders at 10X the IEO price of $0.50 for the first five minutes. After that, the price action was akin to what other launchpad projects have exhibited, i.e., printing a “God candle” of about 70%. If the goal was to protect the users, Binance failed completely.

ARKM found a local bottom around 30% lower compared to its highs. If prior launchpad projects are anything to go off of, ARKM should graze $1 ($1B FDV), as all recent launchpad listings have achieved the same. You could argue that the other listings didn’t have the additional airdrop selling pressure accompanying them, and that would be absolutely correct. I guess we just have to wait and see how this materializes. But with most airdrop sellers having sold, the path of least resistance seems to be upwards and to the right.