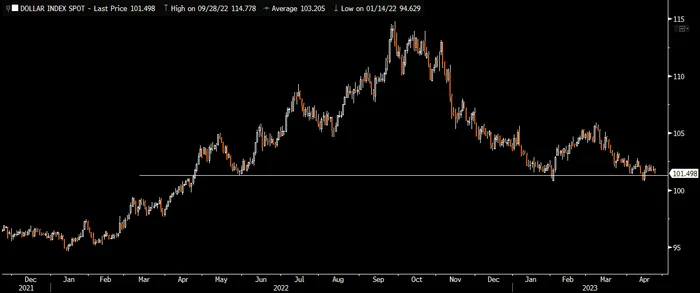

The DXY looks like its struggling to keep its head above water right now. The US dollar benchmark has bounced off the 101 level a couple times already – a break below this level would trigger TA lovers to rally around a reverse head & shoulders move lower.

The dollar will continue to be a key indicator to watch as it relays sentiment on risk sentiment, global financial conditions, and global liquidity. We saw the DXY bottom at the same time as Global Liquidity bottomed back in October.

The risk to the upside is if the market reprices higher rates for longer (and doesn’t see a Fed pause after the May FOMC meeting as it’s currently pricing in). We’ve seen a growing divergence between recent repricing of Fed funds futures and recent weakness in the DXY.

But net speculative positioning is still net long DXY. Historically, big unwinds of long positions have put pressure on the DXY.

But net speculative positioning is still net long DXY. Historically, big unwinds of long positions have put pressure on the DXY.

We’re putting together a longer markets update but for now we’re watching the dollar as it’s trading at a very precarious level.

We’re putting together a longer markets update but for now we’re watching the dollar as it’s trading at a very precarious level.