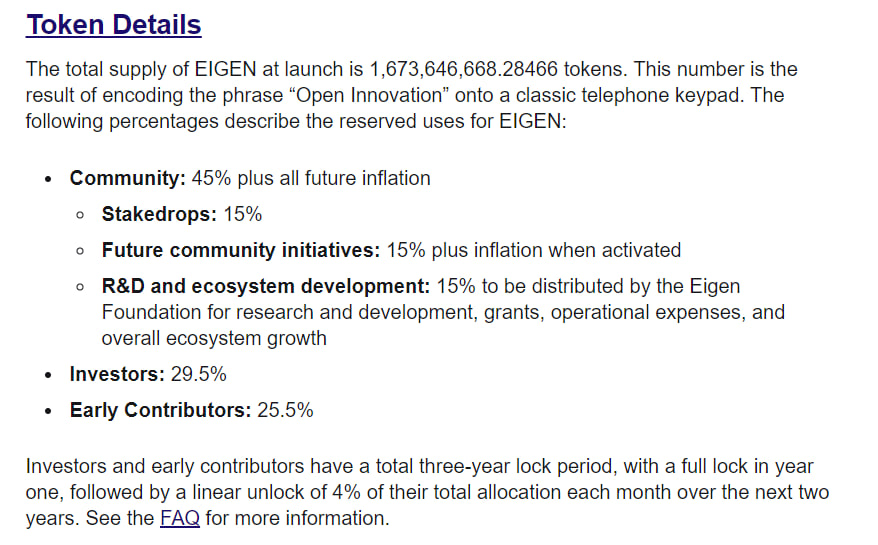

Eigen announced their “work token” yesterday which is coming May 10th. The total supply will be ~1.67B with 15% geared towards an airdrop. 5% of this will be claimable May 10 and then the rest a few months later. Defillama released a cool new tool to check allocations without connecting a wallet: https://defillama.com/airdrops

First, on the airdrop: The airdrop has caused a lot of outrage on twitter for what are seemingly two reasons:

1) non-transferability upon launc

...