Okay, okay, okay, I need an ETF. I can’t take this anymore. Every day I’m checking the price and bad price. Every day I check CT for news, no news. I can’t take this anymore. I have over-invested (in BlackRock stonk) by a lot. It is what it is, but I need an ETF now. Can devs do something???

Based on a few tweets spotted by eagle-eyed members of the Delphi Hivemind, the devs may, indeed, be doing something…

The first tweet comes from @BiasKnox, an anon crypto lawyer, who claims the SEC is meeting with BTC ETF applicants next week.

Fwiw, I have never heard of @BiasKnox before and I didn’t follow the account before today. But I do know @EricBalchunas, aka CT’s ETF whisperer. Eric works as Bloomberg’s senior ETF analyst and quite literally wrote the book on ETFs.

Reading the tea leaves here, this appears bullish. The SEC is quite good at denying ETF applications. They’ve had a lot of practice! So if they plan on denying Mr. Fink & co., why waste time meeting with them beforehand?

We should note that the SEC is, like, super duper busy doing other very important things: like suing the most reputable business in the entire crypto industry.

So, if Darth Gensler and its stormtroopers were just gonna say:

…you’d think a phone call or DM would suffice, not an IRL meeting…

Anyways, the second tweet we’ve been tracking internally is from @LizClaman at Fox Business:

What Mr. Fink will discuss in his 3:30PM EST interview is anyone’s guess. But to read the tea leaves (again) — why would he go live on air if he himself were not bullish on his odds or perhaps knows an approval is coming?

To be clear, I’m not saying an ETF has already been approved or that he’s gonna front-run an official SEC announcement this afternoon. But it doesn’t make sense to go on live TV if you aren’t feelin some type of way (bullish) about your chances.

If Larry were feeling bearish on his odds, why subject himself to a live television examination? Just wait for the SEC to deny you and then issue some bland statement registering your disappointment and have some underling do the dirty work on TV for you. But no, the big man himself — Mr. Larry Fink — is mosying on up to the mic. Bullish.

Anyways, let’s end with a few BTC ETF-related charts that make you go hmm…

BTC is leaving centralized exchanges at its fastest rate this year:

Accelerating withdrawals have led to the lowest BTC balance on CEXs since March 14, 2018 — 1,939 days ago.

Meanwhile, BTC options open interest has soared to ~$13.8B — $1.3B shy of the all-time high of $15.1B.

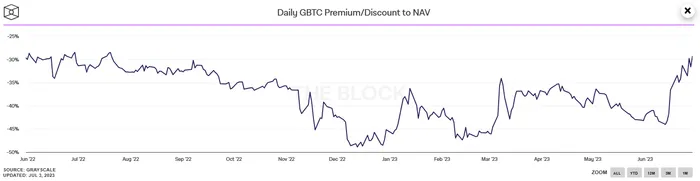

And finally, GBTC’s discount to NAV continues to narrow sharply.