For my longer term holdings I’ve been debating if there is a better way to get exposure to ETH beyond holding spot ETH (or staking via stETH, cbETH and others) and I’ve landed on $ETHE – Grayscale’s Ethereum Trust.

-

Long term I’m bullish ETH and this is buying at $1160 taking the discount in mind (37% discount) while paying a 2.5% annual fee. I think ETH approval is likely to occur before the 2.5% fee noticeably impacts the value of my position on a relative basis vs holding ETH.

-

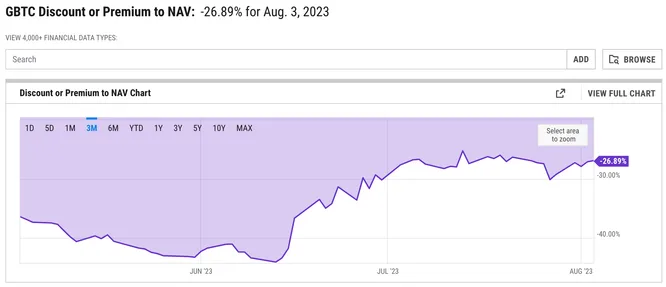

Major players (BlackRock, fidelity, Wisdom tree) all pushing to have a BTC ETF granted. While an Ethereum ETF is for a smaller asset, I believe the arguments are similar. While GBTC is the main beneficiary if a BTC ETF is approved, I prefer to hold ETH over BTC long term, and the discount offers more opportunity (27% discount for GBTC vs 37% for ETHE)

-

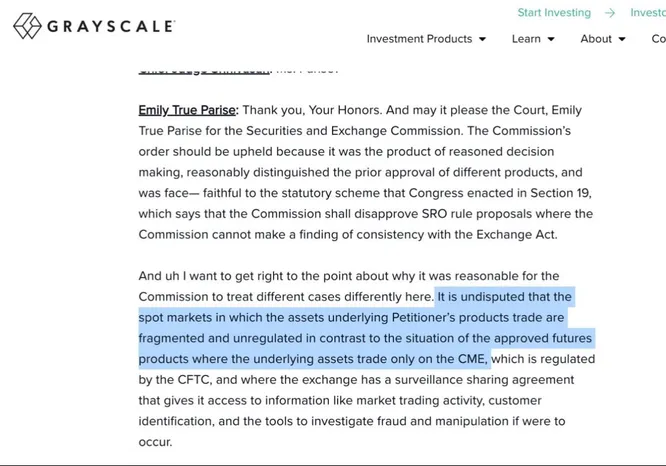

I’m far from a lawyer, but I think the oral arguments between Grayscale and the SEC (link below) favored Grayscale. The SEC’s argument that the approved BTC futures product BITX which trades on the CME offers a more liquid or less fragmented market to trade on vs the massive BTC (or ETH for ETHE) spot market (or maybe more specifically how liquid an approved ETF would be) is laughable. BITX has $24M in volume and trades ~$5M per day per Marketwatch while Coingecko has BTC volume at $7B. I think it’s safe to say markets outside the CME are less fractured and an ETF would be highly liquid.

-

https://grayscale.com/gbtc-litigation-oral-arguments-court-transcript/

-

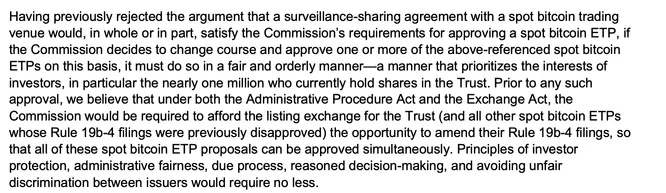

A few on Twitter claimed that Grayscale was against any BTC or ETF approvals. This is not the case. The recent Grayscale letter argued that its trust should be able to convert if an ETF is approved since its technically first in line for an ETF and if not it would unduly hurt them for no reason. I think this makes a fair case that if an ETF were approved, Grayscale should be able to convert GBTC and hopefully ETHE afterward.

-

With ETHE and GBTC, I don’t necessarily need ETH to increase in value, I just need the arb to close to make money. If the underlying assets increase in value, thats extra.

-

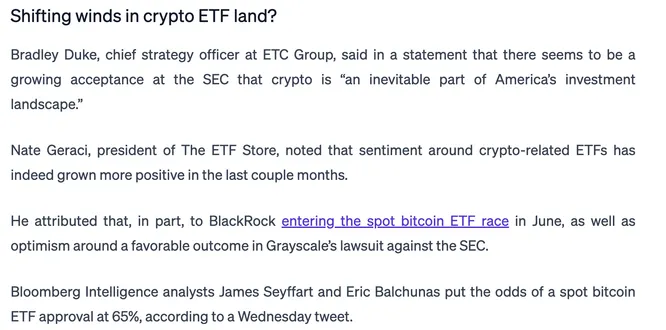

It seems that the SEC is potentially changing its posture toward ETF approvals.

GBTC gaining approval is not a sure thing, nor is ETHE which would use similar arguments in GBTC but have a longer time frame. The downside is the lack of approval for an ETF conversion and the delta widening. I have some comfort here since the trusts are holding spot BTC/ETH at the end of the day and eventually they will be able to convert in my opinion.

This is not financial advice. I am long ETHE.