A new proposal presented by lidomaxi aims to address key issues faced by LDO holders. The proposal introduces an LDO staking module and buyback program that will enhance the token’s utility and allocate a portion of earnings to LDO stakers and holders.

The proposal will introduce the following:

- LDO Staking and Buyback Programs: Token holders will have the opportunity to stake LDO in exchange for 20-50% of Lido’s future revenue. This distribution will occur weekly in LDO through a buyback and distribution mechanism utilizing LDO’s revenue. Earned LDO tokens are vested for 6-months.

- Minimum Size of the Insurance Fund: The proposal sets the minimum size of the insurance fund at 6k stETH. If the fund falls below this threshold, all revenue from stakers will be directed to the insurance fund till it reaches the minimum size.

- Staking Terms: Stakers will be subjected to a 14-day unstaking cooldown period. Stakers are exposed to a potential loss of up to 30% in major slashing events. Any losses incurred will be distributed as follows: Insurance Fund > LDO Stakers (up to 30% of staked LDO tokens slashed) > socialized loss through stETH negative rebase.

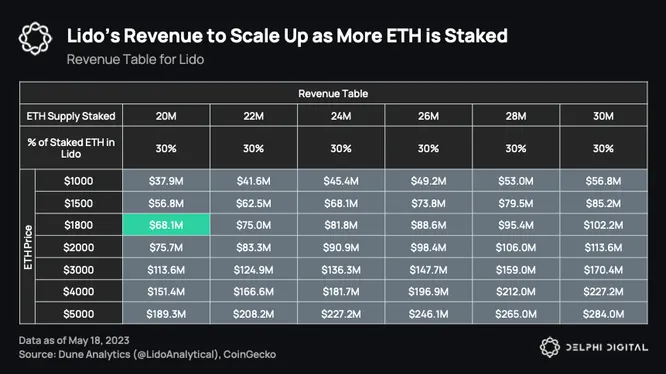

To understand the value proposition for LDO holders, it is important to examine current and potential revenues.

In the given scenario, assuming Lido retains 30% of all staked ETH, the current revenue run-rate stands at $68.1M. With validators queueing and growing amounts of staked ETH, reaching 30M ETH staked would result in a revenue run-rate of $102.2M for Lido, assuming a 30% market share.

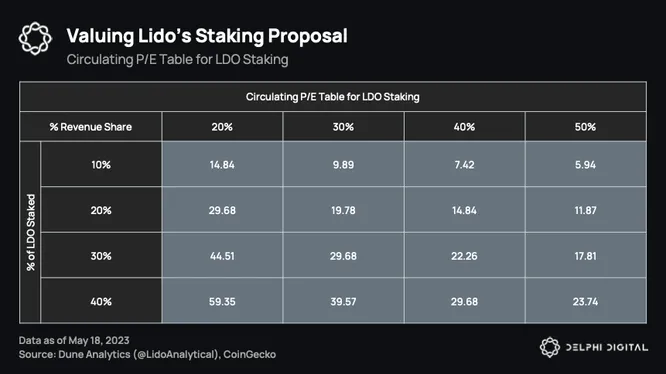

Note: The P/E value is calculated based on the current revenue run-rate of $68.1M, with an LDO circulating market capitalization of $2.022B, and adjusted by % of LDO staked.

If the proposal is approved, the governance will determine a revenue share between 20% and 50% to be allocated to stakers. Stakers will benefit from consistent buying pressure resulting from buybacks and staking yields in vested LDO.

To assess the value of staking, a circulating P/E ratio adjusted for the percentage of LDO staked was employed. At a 20% revenue share and 10% LDO staked, the P/E ratio stands at 14.84, and is dependent on the parameters set by the DAO. A low revenue share will attract lesser stakers, and a higher revenue share will attract more stakers.

Ultimately, Lido DAO has to decide how much excess LDO they would require to ensure sufficient backstop outside of the insurance fund. If 10% circulating LDO is staked (~$200M), this gives them up to $60M in staked LDO that can be used to cover losses. This $60M is six times higher than the 6k stETH (~$10.8M) minimum size of the insurance fund. If the DAO deems that this is sufficient, it is unlikely that revenue share will hit 50% unless stETH shows significant growth that would require more backstops.