FRAX v3 represents the latest iteration of its dollar-pegged stablecoin, aiming for it to be fully collateralized by exogenous collateralization.

At its core, it relies on AMO smart contracts and a mix of permissionless, non-custodial subprotocols to anchor its stability. Internally, Fraxlend and Fraxswap are used as stability mechanisms, while Curve is an external protocol used for stability.

With U.S. T-bills outperforming on-chain yields, Frax v3 moves toward a strategy that utilizes RWA.

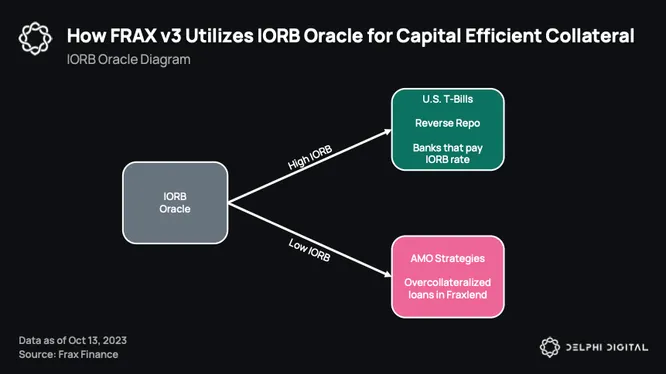

FRAX v3 taps into the Federal Reserve’s Interest on Reserve Balances (IORB) rate through an IORB oracle integration. Higher IORB rates trigger a shift towards more RWA collateral like treasury bills and USD at Federal Reserve Banks, while lower rates prompt a rebalancing towards on-chain strategies. This aims to optimize collateral to be more efficient in generating income for Frax.

Frax’s RWA strategy only allows for four assets:

- Short-dated U.S. T-bills

- Federal Reserve Overnight Repurchase Agreements (Reverse Repo)

- USD deposited at Federal Reserve Banks

- Money Market Mutual Funds

FinresPBC has been onboarded as the primary RWA partner, emphasizing low-risk cash equivalent assets that yield close to the IORB rate. These yields generated will be passed onto staked FRAX (sFRAX).

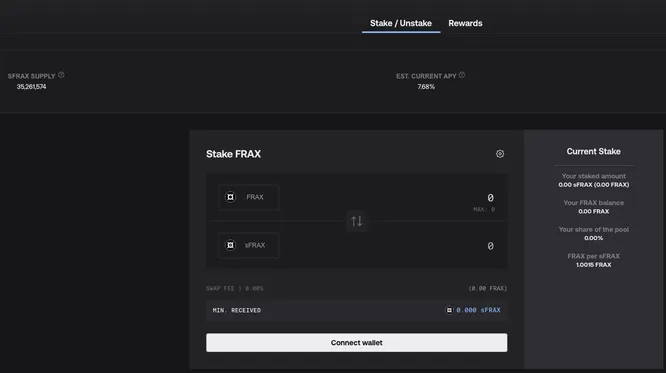

The sFRAX vault offers staking opportunities with returns in FRAX stablecoins. The vault aims to track the IORB rate of the U.S. Federal Reserve, a recognized risk-free rate to offer traditional yields on-chain on the FRAX stablecoin. The yield is primarily sourced from strategies employed by partner custodians like FinresPBC.

The sFRAX vault’s APY is influenced by a utilization function, which can be adjusted by the FRAX governance. The utilization curve starts at the top end of 10% APY and reduces as more FRAX is staked in the vault. As more FRAX is staked, the protocol aims to deploy these assets to source yields that closely match the Interest on the IORB rate. This strategy aims to maintain the lowest APY closely aligned with the IORB rate, as indicated by the oracle.

Currently, 35.2M FRAX is staked and is currently generating 7.68% APY. This is higher than the Enhanced DAI Savings Rate (EDSR) of 5%.

Lastly, Frax Bonds (FXBs) are introduced. FXB tokens operate similarly to zero-coupon bonds, converting to FRAX upon maturity. They represent debt denominated in FRAX and solely convert to FRAX stablecoins.

FXBs will be auctioned through a unique gradual Dutch auction system that has quantity and price limits set by the governance. This ensures that FXBs are not sold for prices lower than the floor limit, eliminating toxic arbitrages against the protocol.

With FRAX v3, sFRAX will unlock opportunities for users to earn high interest from U.S. T-bill-related products. This is likely to attract stakers to sFRAX and compete with DAI for depositors looking for stablecoin yields.