The team at Gearbox published a blog post introducing the third iteration of the protocol. v1 was an MVP and v2 was meant to test the boundaries of on-chain credit. With the third version, Gearbox is finally aiming for product-market fit with some reworked mechanism design.

In a nutshell, the core idea behind Gearbox is the same, but the architecture of the protocol has been updated to be more modular from a risk perspective. From the periodic updates they publish, it’s obvious that they have been focused on risk mitigation more than anything else. This was required as Gearbox seeks to finally be deployable on rollups, which demand more intense risk-analysis and a more performant liquidation engine amongst other things.

The design of Gearbox’s core pools has changed. There will be a “blue chip” lending pool for lenders with lower risk tolerance. Funds borrowed from this pool will serve limited purposes, like perhaps high-quality levered strats and margin trading established crypto assets. There will be pools with higher associated risk tolerances, where borrowers can deploy strategies with higher risk.

Source: Gearbox

The process flow is fairly simple: all lenders put their money into the universal pool and can delegate their capital into one of the ancillary lending pools. This opens up the door to managed lending pools. An example of this would be a vault management product deploying its own Gearbox money market and whitelisting only its own contracts to be used by borrowers. This enables a DAO or protocol to help their own users access capital efficient leverage without having to lobby the GearboxDAO to whitelist them.

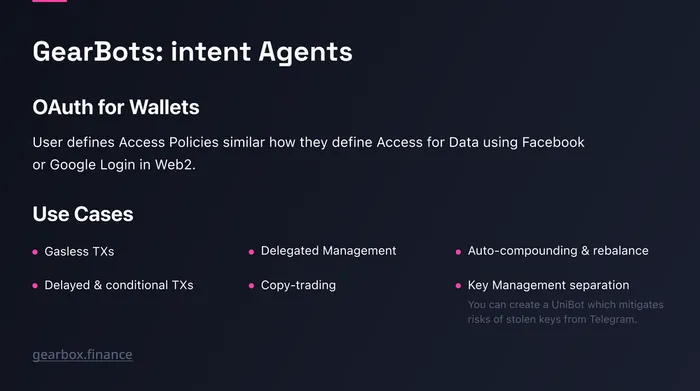

Gearbox v2 used multi-call to batch actions together and make it easy for a user to do multiple hops in a single transaction. v3 takes this a new level by introducing what the team is calling “intent agents.” Intent agents are bots — called “gearbots” — that can help users automate the management of their strategies. Programmatic limit orders, stop losses, asset re-balancing, and liquidation mitigation are all possibilities with intent agents.

Source: Gearbox

The most confusing and complex part (at least for me) of v3 is the introduction of collateral quotas and dynamic interest rates. Since Gearbox allows for more than 1x leverage — something over-collateralized money markets cannot do — risk is an even bigger concern. The stand-off between Michael of Curve and Aave governance taught lenders that LTV ratios aren’t the only thing they should care about. If there is $30M of a token used as collateral in Gearbox but only $15M worth of liquidity for said token across DEXs, bad debt would be a certainty if the borrower’s position was moved into liquidation. To mitigate this, Gearbox introduces collateral limits. This is pretty simple.

The trickier part of this system is collateral quotas. Every asset has a different interest rate associated with it and is subject to change. Inside of a collateral limit, every user has the ability to set their quota i.e. $x of my holdings in XYZ asset will be used as collateral in the system. Obviously every user will want 100% of the assets in their credit account to be treated as collateral. But collateral limits may not allow for that to be possible. So with that in mind, the quota is a system to make each user’s share of the collateral limit more equitable — rather than a handful of whales taking up the entire limit.

The second part of this system is the gauge — which determines the interest rate for the an asset. It’s essentially a token-voting battle between borrowers and lenders that own GEAR to find the equilibrium in interest rates for an asset. The team plans to implement this in a way that abstracts a lot of the complexity, like having auto re-rolling of votes each epoch unless a voter explicitly changes their stance.

Finally, the million dollar question of a revenue-share was addressed. Gearbox’s public stance has been that the focus is not on fees and revenue, but primitive development and PMF — so this represents a real change in outlook.

If you’re interested in digging deeper, I would recommend reading the entire blog post linked at the top. I have my own thoughts on Gearbox as a primitive and what v3 brings to the market. If you would be interested in a follow up to this post, drop us a comment below!