On-chain yields have become dry, and newly launched yield farms do not last long. Here, I will share some creative strategies to generate yields through a delta-minimized lens.

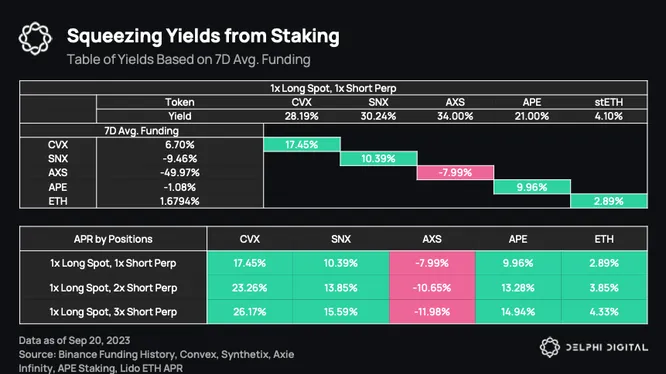

Our focus is on tokens with single-sided staking rewards paired with a perpetual listing. The approach involves staking these tokens to capture yields while concurrently hedging spot exposure using perpetual swaps. With that, I’ve shortlisted five tokens, CVX, SNX, AXS, APE, and stETH, to be used for this analysis.

Benchmarking our results, we’ve employed the DAI Savings Rate (set at 5%) as our minimum return metric. Strategies yielding less than 5% are labeled as sub-optimal . Consequently, AXS and stETH are excluded from the list.

CVX, SNX, and APE generate >5% yield at 17.45%, 10.39%, and 9.96%, respectively. With leverage, the strategy becomes more capital-efficient and generates a higher yield. This creates a lucrative avenue for synthetic stablecoin exposure.

However, do note that each of them poses certain risks.

- Staking-related risks: CVX requires the staker to lock for 16 weeks + 6 days and vote on a bi-weekly basis through Votium. SNX staking minting sUSD debt, maintained at a 500% collateralization ratio, accompanied by a 7-day unstaking cooldown. APE is the most streamlined, with only a straightforward staking required with no lockup duration.

- Perpetuals funding rate: The funding rates of each token can fluctuate drastically, causing higher funding payments. This reduces overall yield.

- Fees and spread: An important factor to take note of is the fees incurred and if there is a spread between spot and perpetual pricing that could impact returns.

- Smart contract risks: Staking means exposure to various smart contracts that could be exploited.

- CEX risk: Exposure to CEXs as these perpetual listings are usually only available there.

This strategy is not limited to the tokens listed above and can be utilized on any token with single-sided staking and perpetual listing. As typical DEX yield farming becomes highly competitive, this strategy faces lesser competition and can potentially last for a longer duration.

Disclosure: I have participated in some of the abovementioned strategies. This is also for informational purposes only. Nothing contained in this is, and should not be construed to be, investment advice.