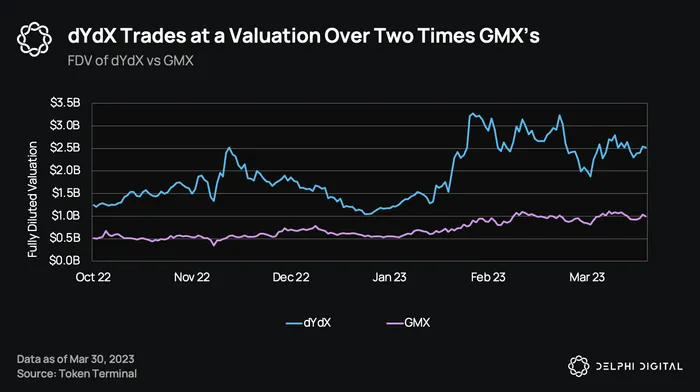

Open interest on GMX has grown over 100% YTD, overtaking dYdX whose open interest hasn’t increased as drastically. Despite this, dYdX still trades at fully diluted valuation over two times higher than the GMX.

dYdX FDV is $2.33B versus GMX which trades at $957M.

dYdX FDV is $2.33B versus GMX which trades at $957M.

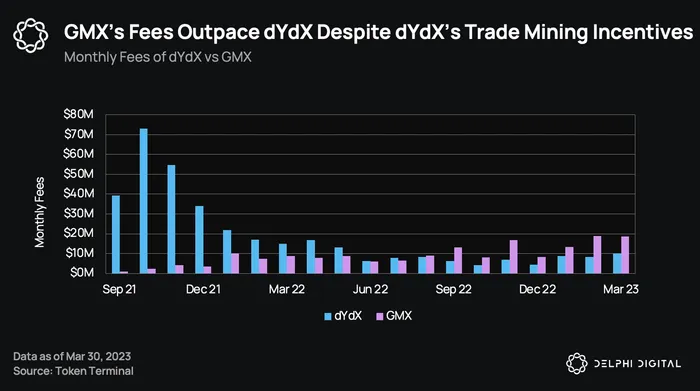

In terms of fees, GMX has also outpaced dYdX over the last year, as dYdX trading rebates dwindle. The dYdX community voted in February this year to reduce trading rewards by 45% every epoch. Excess tokens will instead go to the treasury for the DAO to fund initiatives for dYdX v4. Last week, the protocol announced details of the upcoming v4 launch here. GMX on the other hand, does not give trading rebates but manage to sustain and even grow trading volume. This is partly due it being a beneficiary of the recent Arbitrum rush.