Lucky, the co-founder of Rollbit announced in a tweet thread that Rollbit’s futures product has done over $72B in volume over the past 30 days.

This starts to put Rollbit in the same ballpark as some of the leading centralized derivatives exchanges like ByBit (30-Day Derivatives Volume of $270B).

Lots of people have never heard of Rollbit before a few weeks ago, how is possible they are generating this much volume?

Since Rollbit allows up to 1000x leverage, a small amount of underlying collateral can create massive amounts of notional volume. With 10-40M in collateral levered 100x, you easily can get to a $1-4B daily volume number. This is assuming only 1 trade per day…

To understand how much collateral is needed we must examine two key factors:

1) Leverage used on the platform (anecdotally we can tell from the leaderboard that traders seem to prefer higher leverage 50-500x)

2) Turnover per day, we don’t know how many times that same underlying collateral is being turned over per day.

So as a guess, with an average leverage of 100x, and an average daily turnover of 2 times:

$1B in volume requires – $5M in collateral

$4B in volume requires – $20M in collateral

$5-20M in collateral doesn’t seem like that much after all despite the massive notional headline volume! But as we know from projects like GNS & GMX leverage traders seem to lose money over time, thus a constant stream of deposits is needed to replenish the lost collateral.

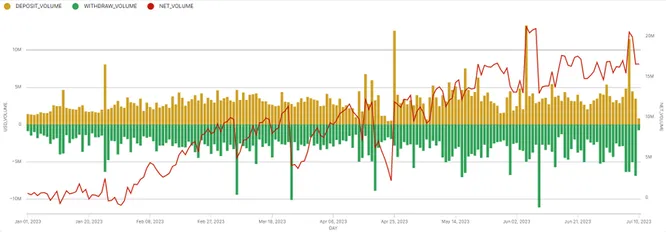

A dashboard I’ve been watching that tracks daily deposits into Rollbit from Solana & Ethereum is https://flipsidecrypto.xyz/Masi/rolling-with-rollbit-wScaX6… Note this doesn’t track BTC data.

On Ethereum, we see that Rollbit is consistently averaging between $3-4M in daily deposits. For me, deposits are the most useful indicator to look at because withdrawals don’t necessarily mean user withdrawals (it can also be Rollbit themselves sending funds to cold storage & profits)

On Solana, we are seeing 500k-1M in average daily deposits. So adding this up we are seeing anywhere between 3.5-5M in daily deposits. In the month of June we saw >100M in deposits from Solana & Ethereum (note this doesn’t include BTC data).

Although Rollbit has a Casino & Sportsbook, in my opinion, recent daily deposits in the realm of $3.5-5M a day seem like more than enough to sustain the current pace of perp volume. Especially since the large volume perp days in early July coincide with larger deposits.

Now we know that it is at least feasible Rollbit is generating this volume through organic means, maybe we can try to guess Rollbits revenue from perps. To do this we need to take a step back and guess how Rollbits futures trading even works.

Traditional perpetual futures like you would find on Binance work as such: Every long is matched up with a short, so it is completely zero-sum. Neither the exchange nor do a group of LPs take on profits/losses if longs or shorts are making money. (Except for when bad debt occurs).

Rollbit seems to be taking the other side of each trade that happens on its future platform. From an optimistic point of view, one would reason they are hedging out their risk on CEXs and/or are in the process of building up an insurance fund.

Given Rollbit’s fee structure they seem to have ample room to hedge positions. The fee options are:

1) Flat fee starting at 4.1bps (reduced by holding more RLB)

2) No flat fee but an effective house edge ranging from roughly 10-30% depending on the leverage you use.

From here we can start estimating revenues. Some people have applied the 4bps to the $1-4B in daily volume number for a whopping $400K-1.6M in daily revenue. Although this may well serve as a proxy I think the logic is flawed.

Since you can use up to 1000x leverage on Rollbit I think many of the high-leverage traders will not be using the flat 4bps fee and instead opt for the house edge model. If you were to enter a 1000x long this effectively gives you 700x-900x on the upside and 1000x on the downside.

Recently Lucky has confirmed my suspicion stating >$70B of the $72B in 30-day trading volume used the house edge model.

From Rollbit’s point of view, they make money if traders lose and have some breathing room to hedge out their exposure on the upside. Since we know that BTC & ETH volatility are insanely high + long-standing case studies of GNS and GMX we can assume most traders are losing.

It is kind of impossible to tell how much money Rollbit is making and I think a data dashboard would go a long way and help clear up transparency concerns that some members of CT hold. But I think you can use deposit volume as a proxy for revenue generation.

Across Solana & Ethereum June deposit volume was ~$100M. In July there has been $55M in deposits so far, putting them on track for >$150M this month.

Given Rollbit is a Casino, I don’t think it is crazy to assume they are making in revenue between 10-30% of all deposits.

If correct…

That puts them earning $120-360M/year based on June deposits, and $180-540M/year based on projected July deposits. This would put them easily into the top 5 highest revenue-generating protocols.

If anyone is an expert on Casino’s I’d love to know what they make relative to what is deposited. Of course, Rollbit also has lots of costs into generating this revenue and on the perps side is probably funneling a large chunk away for an insurance fund.

Please note this thread is operating from an optimistic standpoint (assuming Rollbit is not a bad actor) and more data/analytics from the team would be very helpful in increasing transparency.

Disclosure: I own $RLB