On June 19th, trading volume for Goblintown NFTs pumped 3,857% after a game that featured the IP’s artwork went viral on Twitch.

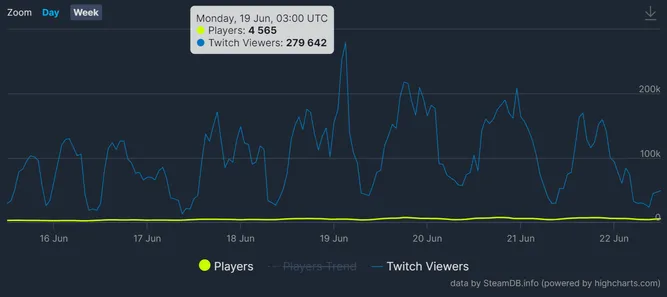

Up Only! is an unforgiving vertical climber that has held an average of 4.5k players since its launch on Steam and hit a peak of 280k viewers on Twitch. How this impacted an NFT collection’s floor price is because Goblintown visuals were featured throughout the game, including the logo being slapped directly on the protagonist’s t-shirt.

Despite numerous influencers blindly stating that this was an officially licensed NFT game, there is no connection between the two projects, apart from one/some of the developers at SC-KR Games allegedly owning some NFTs.

Taken as a case study, this shows that there is a clear path for developers to build hype within the Web3 bubble and that this can significantly impact NFT sales and prices. Since the hype started, the project has generated ~80ETH in volume, and the floor price is currently resting at 0.33ETH (roughly 60% higher than before the pump).

However, this does not come close to the upside provided to the game developers by simply making a viral game. With 7k all-time peak concurrent players, as many as 167k downloads, and a box price of $9.99, the team will have brought in as much as $1.17M after fees from Steam. This is compared to the <15ETH in royalties given to Goblintown since June 15th.