The IOSCO policy recommendations for DeFi came out today and they are…. depressing. Many initial reactions are currently rolling out on Twitter (including mine) but on a really high level, I would caution against looking at this report as something to seriously engage with or respond to within the comically short comment period (read: they have made up their minds). It should instead be looked at as a blunt-force policy instrument of the SEC.

Along the same lines, it serves as a reminder of the long reach of the U.S. government in shaping (or exerting force to attempt to shape) international policy – especially given the trend in crypto to block, insulate or otherwise try to distance itself from the U.S. These recommendations are, in short, an attempt to pressure other world governments to mirror and implement the U.S. approach as the SEC prepares to finalize Reg ATS. So while the ‘working group’ includes other world powers, this report is one where the SEC was at the helm and it unsurprisingly has all the hallmarks of this SEC that we have become familiar with:

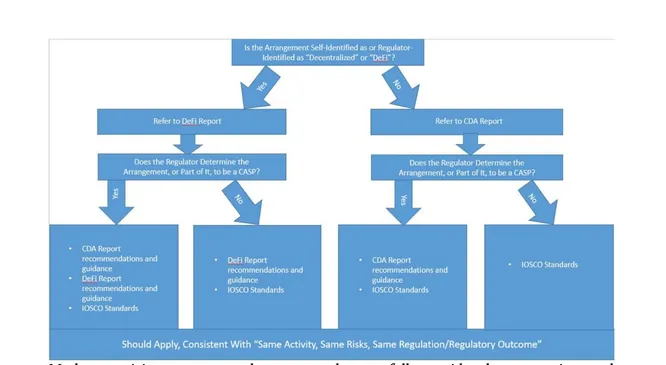

(1) it seeks to make a broad unified policy stance from Chairman Gensler’s speeches – using sweeping conclusory language achieved by massaging bad facts or optics to fit his pre-determined narrative: that we do not need to grapple with complicated policy issues because there is nothing new or novel here in DeFi. Instead, DeFi involves the same old financial products and business models run by natural persons. It follows that the same activities should involve the same regulatory outcomes – so existing law should and does apply (with maybe some additional regs for additional risk from use of code on top). And yes, let’s just ignore that the SEC is simultaneously working on rule changes to fundamental definitions in Reg ATS to apply this existing law.

As illustrated by the above flowchart (which is not intended to be ironic), if you say you are “DeFi”, all paths then lead to the same outcomes under these recommendations.

(2) the report (uncharacteristically for IOSCO) was drafted and released, as far as anyone can tell, without first seeking input/feedback from the industry or relevant policy orgs. it denies the industry a voice in formulating the report and again, seeks to do so on the back end through the non-existent comment period; and

(3) the report leans into international coordination – this usually makes sense if the report puts forth a balanced approach that each country might reference to develop its laws. It is less innocuous in the context of recommending a de facto ban on DeFi with appeals to ‘coordination’ as a means to advance the SEC’s agenda . Coordination and cooperation here means falling in line through adopting the same approach with coordination of enforcement against the natural persons behind DeFi.

In short, this report is a harbinger of Reg ATS. I had hoped ATS would be deprioritized due to (i) Gensler’s recent pivot /Eye of Sauron moving to AI, (ii) the sheer volume of SEC proposed rules competing for bandwidth, (iii) together with the depressed activity levels/ generally minuscule size of the DeFi market relative to the overall markets/market participants under the SEC’s purview. The SEC would not have expended the resources they did here without plans to move forward on Reg ATS – Chair Gensler is nothing if not strategic and politically adept.

TLDR – we will absolutely need to bring the battle on Reg ATS to court. That battle will need to play out for years in the courtroom (perhaps pushing out the compliance periods). In the interim, what this report does offer is a direct view into the SEC’s playbook for enforcement – it provides an overview of how the SEC views a wide variety of activities and the arguments they will make in the context of potential enforcement actions.

Link to the full report here: https://www.iosco.org/library/pubdocs/pdf/IOSCOPD744.pdf