Crypto ramps suck. On-ramping from a bank account > CEX > Web3 wallet can take up to 6 days. Thanks to Coinbase’s debit card and similar new products, off-ramping to make a payment can take as little as 10 minutes, but the UX is far from ideal. To fully transfer funds from Web3 wallet > CEX > bank account, users can expect to wait a few days for the deposits to clear.

The hang up is, of course, not on crypto’s end. Antiquated tech of legacy finance and KYC/AML are the culprit.

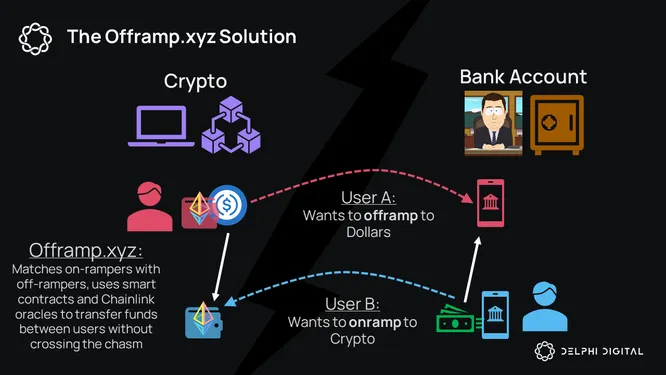

Offramp.xyz is building an instant, non-KYC offramp. It operates as a peer-to-peer exchange that will match crypto on-rampers with crypto off-rampers. Rather than move crypto from the blockchain to a bank account, Offramp.xyz will shift crypto between wallets and fiat between Wise accounts. Crypto funds will be stored in an escrow contract, and Chainlink oracles interface with read-only bank APIs to ensure funds are transferred. A short video demonstration can be found on the project website.

In the future, Offramp.xyz will use liquidity pools to allow for instant offramps. Reasonable fees of 0.3% for P2P and 1% for liquidity pool (instant) are better than most current onramp methods, which charge outrageous fees and have caps as low as $500.

This is a creative solution that could be a huge QOL improvement for crypto users. That said, it is more of a roundabout fix, and the fundamental issue still exists. For that reason, there will likely be limited impact as far as integrations with other projects and unlocking new use cases. This is a cool project, but likely not a lightbulb moment for crypto. Offramp.xyz is understandably not available for US users.

There is also signs of development on the infrastructure front. Andre Cronje recently teased a payment system on Twitter. It turns out that Fantom Foundation used all that yield farming money for something productive – a banking license.

The entity is currently known as Universal Assets Bank, and will be a more traditional financial services platform, requiring KYC/AML. It will be available towards the end of the year, and initially will not be retail facing. There are different types of banking licenses, and further details regarding Fantom Foundation’s banking roadmap are unclear. Aave was granted a UK Electronic Money Institution license in 2020, which has thus far turned out be uneventful.

Still, it is encouraging to see a non-zero amount of development in the offramp/crypto-banking space. Crypto ramps are currently a huge barrier to mass adoption and real world use cases. If Universal Assets Bank can become a viable alternative to Circle and Coinbase for crypto related business and payments, it is a big step in the right direction.