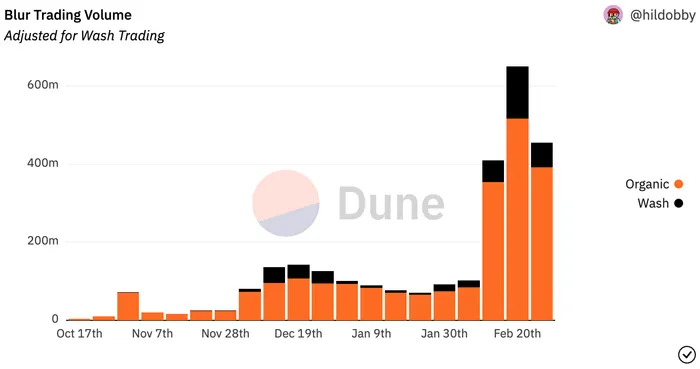

bLuR’S tRaDiNg acTiViTIeS aRe aLL fAkE, iTs wAsH tRaDeS! Is this statement true? We take a closer look below.

Based on @hildobby’s magical querying filter, we can see that a mere 11% of traded volume was flagged as wash trading throughout Blur’s existence. The reason for this is likely due to Blur choosing to incentivize liquidity rather than volume, which has been reiterated many times, but the catch here is this: By choosing to incentivizing liquidity, you are encouraging bidders to take on the price risk for bidding (and sellers for listing), without any influence of trading volumes. The amount of volume traded does not count towards the BLUR airdrop, which disincentivizes wash trading.

Previously, Blur competitors such as LooksRare and X2Y2 has resorted to incentivizing volume in order to attract users on their platform. The goal was to artificially inflate their trading volume to gain maximal fungible token rewards, which distorts the actual volume data and make the marketplace look like it’s actually chipping away market share from the incumbent OpenSea, when in fact, the entire thing was a facade and simply the work of mercenary capital extracting as much value from incentives as possible.

As seen from the above, the majority of volume on LooksRare and X2Y2 ended up being wash trades, which is a direct result of the marketplaces incentivizing volume, rather than liquidity. Hence, Blur have shown clear signs of organic activity happening, although the data is still inflated due to token incentives. With 2x rewards in Season 2 ending on April 1, we might see Blur bidding pool TVL drop as mercenary capital rotate to greener pastures. Blur likely knows this, and will likely announce more details on BLUR utility down the pipeline. Right now, they have hinted at the idea map, and we can expect Blur to continuously retain users in various ways beyond just token incentives. The goal with Season 2 is likely to alter trader behaviour, by familiarising traders with Blur’s tools (at the expense of BLUR tokens), but as long as it helps user remain sticky, the team have achieved their goal. Switching costs in web3 is low, as a mere token incentive will drive opportunistic capital towards their way.

Ultimately, it will come down to superior product experience in my opinion, because while incentives run the world, incentives will eventually run out. The staying power with two-sided marketplaces such as Blur will be dependent on how sticky its user base are. Hence, it is pivotal for the team to ensure they have the most superior product experience for their targetted market segment through constant iterations and customer feedbacks.