The promise of truly free, permisionless markets is a hallmark of crypto. Protocols and products are free to be spun up at will and deployed. The market then decides whether this product will gain traction or not. There are no real crypto-native regulations or corresponding loopholes other than the rules baked into execution and consensus layer logic. But there is also social consensus around right and wrong.

Recently, we have had fervent debate around the state of Lido and its dominance over Ethereum staking. Lido is responsible for 73% of all liquid staked ETH and is inching closer to accounting for 33% of all staked ETH. And this is troubling a lot of protocol researchers.

A lot of prominent names in Ethereum have called for Lido to self-limit its growth. Lido core contributor Hasu responded with a proposal of their own. But is it fair to say Ethereum is a free market and then ask protocols built on top to slow down because they’re growing too fast and eating up their competition?

As always, there are two valid sides — and nobody is the enemy. But this has been a long time coming.

Staking is crucial to the functioning of Ethereum. Liquid staking is a crucial part of opening up the staking opportunity to a larger audience. In an ideal world, you would have multiple providers who have a healthy amount of market share. It looks more like an oligopoly — a handful of players, none of whom has more than 33% of ETH staked, all competing on a level playing field. However, the reality of today is that Lido monopolizes the ETH liquid staking market.

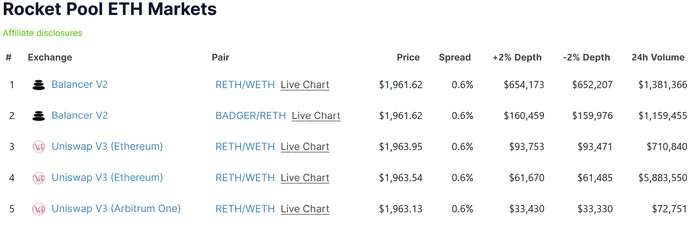

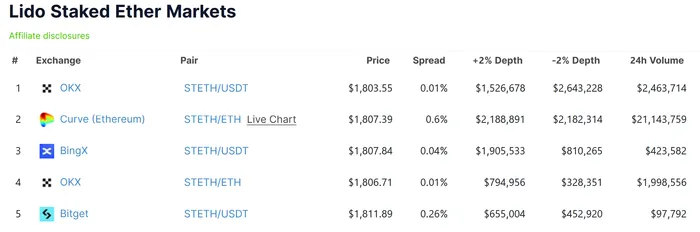

It’s not that Lido held a knife to their competitions throat. It’s that, honestly, it’s just a better and more user-friendly product. Since Ethereum does not have liquid staking baked into the protocol like the Cosmos Hub, each liquid staking provider has a different staking receipt token (stETH for Lido, rETH for Rocketpool, etc). These receipt tokens are not interchangeable between different providers. Network effects with such a system are built on liquidity i.e. which liquid staking provider’s receipt token has the most liquidity and thus can be exited easier (and more useful in DeFi).

rETH Liquidity

stETH Liquidity

The free market chose Lido. And in the end, there are several parties that are responsible for this — including Ethereum protocol researchers, designers, and developers.

For the average user, Ethereum’s health is a higher priority than Lido’s cash flow. And rightly so. Protocol health should be the primary concern — especially for things built on Ethereum. After all, if Ethereum was to lose its status as a credibly neutral platform, Lido would be worse off (best case) if not completely devoid of value (worst case).

But you can also understand why Lido’s stakeholders are attempting to fight back in their own way. They simply built the best liquid staking product and users came. Their dominance is simply a consequence of the market actually being free to pick winners and losers.

It should be clear that we are better off with Lido’s dominance over, say, Binance or Coinbase staking. Lido has a distributed validator set that helps them deploy their users’ ETH into staked ETH. So it’s not entirely concentrated. Lido is open to conversation and debate around how to reach the optimal end-state. And while DAOs should be profit driven, I think Lido stakeholders understand the dichotomy of short-term profit and long-term network health.

So in the end, my takeaway is that both sides are valid. And both sides will have to compromise in some way. If Lido can find a way to maintain Ethereum’s integrity without self-limiting, it’s the best of both worlds and doesn’t set the precedent that you can become “too big to grow” on Ethereum.

So yes, it is fair to ask Lido to self-limit. It is also fair for Lido to request discourse to find a way around this.