Jupiter launched their token JUP ~3.5 hours ago now, how did Solana perform? I’ve curated some high signal tweets to give a better picture.

First, the one above from Solana Compass. Real/non-vote TPS was hitting 600-800 over the hour post airdrop.

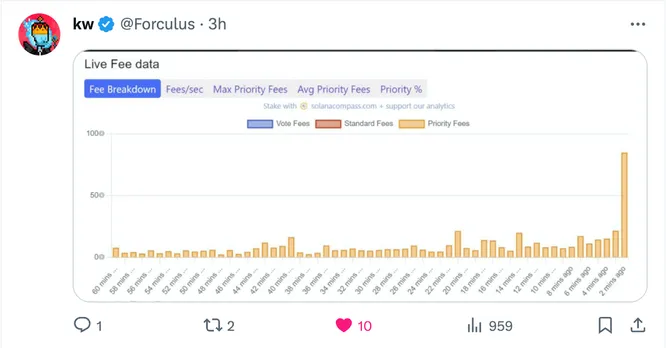

Next, priority fees spiked hard at time of mint and stayed elevated for some time. Priority fees hit ~100 SOL in the first minute of JUP drop.

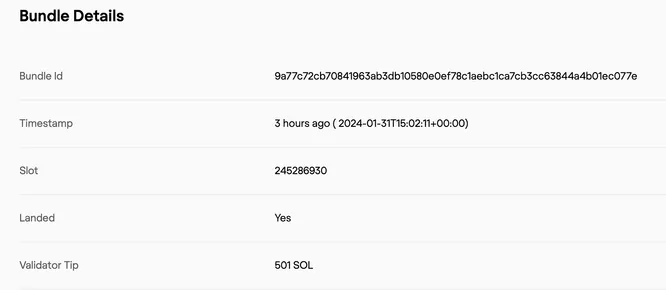

Shortly after mint, Jito had a 501 SOL (~$50k) tip paid through a bundle.

From a validator perspective, network ingress spiked but returned to normal levels relatively quickly.

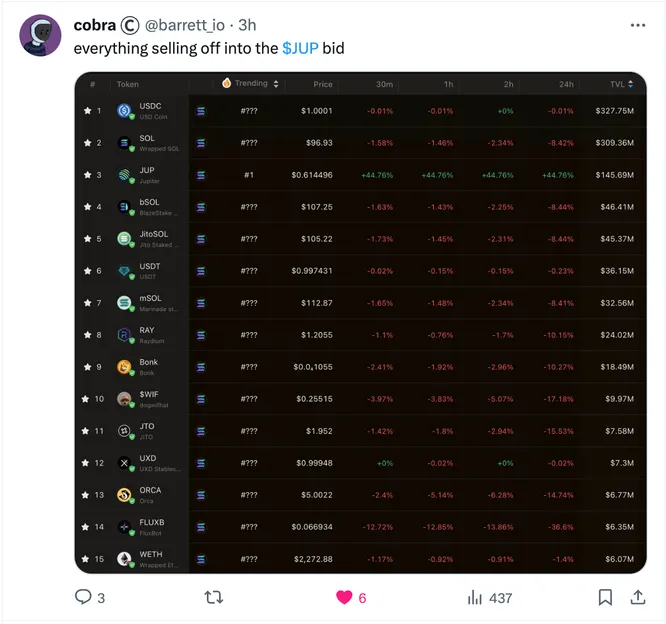

What about price action? JUP acted as a liquidity black hole in the first few hours post drop as all eco tokens and memecoins dropped by ~10-20%.

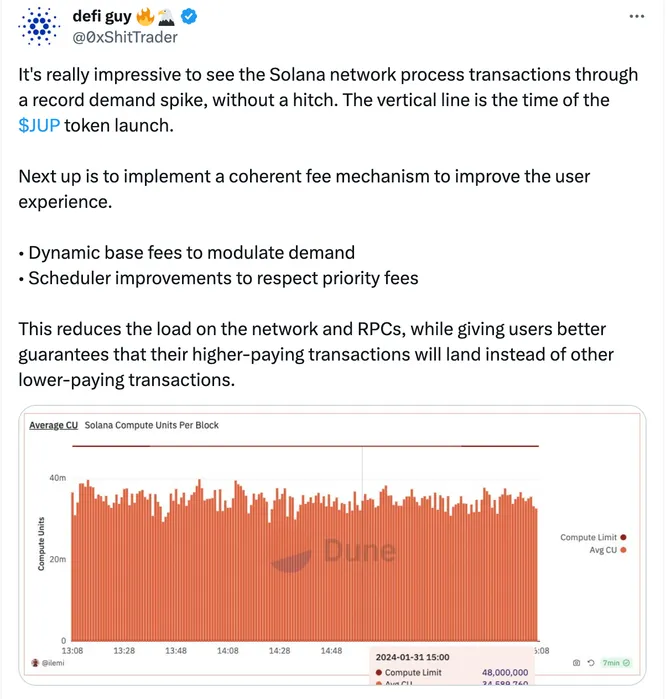

Was the launch perfect? Solana has come a long way but it was still by no means perfect. The new scheduler in 1.18 should improve priority fees and changes to the fee markets should help further. For more info on the latter I would read this article released by Umbra yesterday: https://www.umbraresearch.xyz/writings/toward-multidimensional-solana-fees

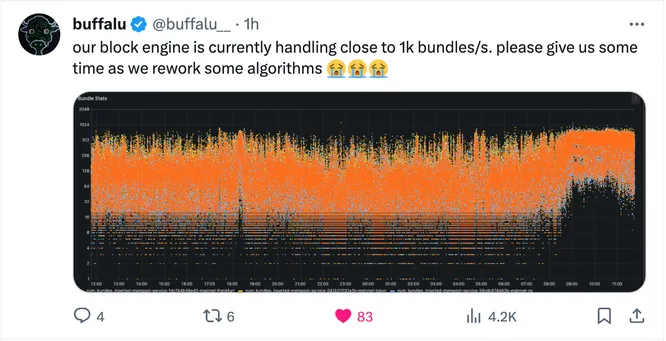

Jito has been stress tested all day, handling close to 1k bundles/second.

And Helius too, while maintaining near perfect uptime throughout it all.

Overall, this can’t be seen as anything but a win. There is no way the network would have functioned anywhere close to this a year ago.

It wasn’t perfect. Some users had trouble claiming, transactions were failing. But things worked *relatively* well, with clear paths (scheduler, dynamic base fees, firedancer) in the pipeline to continue improving.