Building off an earlier post, Powell’s hawkish commentary this week caused a sizable repricing in rate expectations. The market is now pricing in a ~70% chance of a 50bps hike at the March FOMC meeting (two weeks from today), up from 25% at the start of the week. Unsurprisingly, the US Dollar Index (DXY) is waking up too.

Powell acknowledged that recent data may warrant a reacceleration in rate hikes. We see this in the US Economic Surprise Index too, which has trended higher the last several weeks compared to the start of the year.

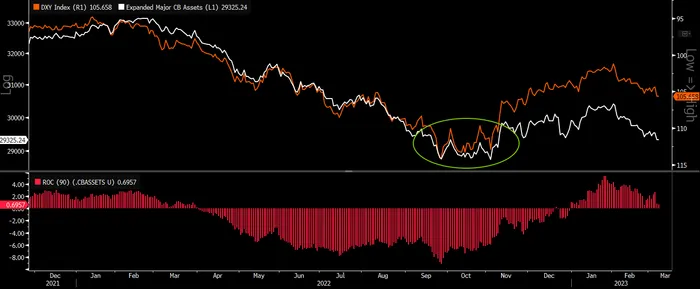

The dollar has since rebounded to a 3-month high, but its move really started back in early February (at the same time equities peaked). The growth in major central bank balance sheets is once again rolling over, taking some wind out of this year’s liquidity-driven rally.

There’s a lot riding on this week’s jobs report and next week’s CPI print. If both come in stronger than expected, it may give the Fed room to take more serious action on the rates front.

But a step up back to 50bps is meaningful, not so much because of the impact of an extra 25bps move, but because of the signal it sends to the market, especially those who continue to question the Fed’s resolve.

Watch the dollar from here. It’ll tell you a lot about the state of liquidity, rate expectations, and general risk sentiment. Where the dollar goes, so often too does the market.