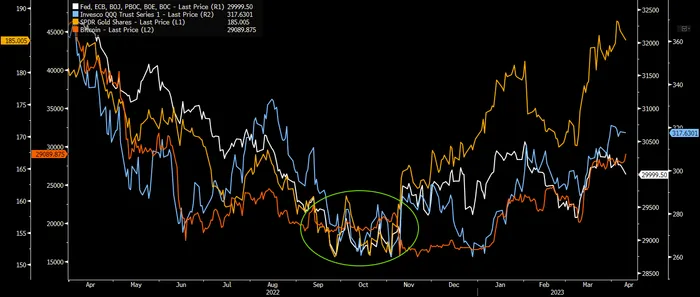

Much continues to be made of the recent resurgence in markets like tech stocks, gold, and crypto. But all of these are liquidity-sensitive assets in some form, as we discussed during the most recent Bull vs. Bear episode.

If global liquidity continues to expand, I’d expect these markets to move in the same direction, especially gold and crypto.

Global liquidity expansions tend to see a weaker dollar, which benefits scarce assets as the denominator they’re priced against gets debased.

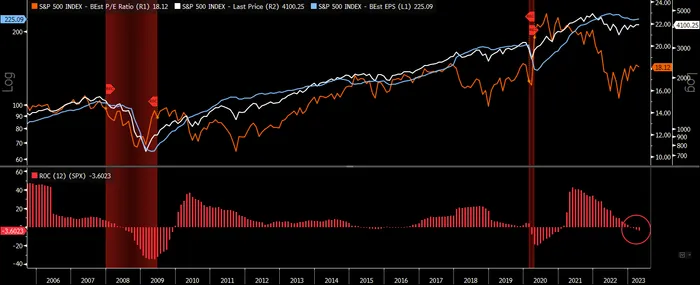

Earnings may still be a headwind for equities as the Q1 reporting season kicks off, but there’s still an argument that the worst has already been priced in. Forward earnings expectations have turned negative year-over-year, as we typically see around recessions.

Equity multiples have come down considerably over the last 18 months though, and price multiples tend to expand when global liquidity rises.