Prisma will be increasing its debt cap for all four of its liquid staking collateral on 15 Sep 2023 at 12pm UTC. (Tomorrow)

As a primer, Prisma is a CDP-based stablecoin protocol specifically targeting liquid staking tokens (LSTs). Here, they allow depositors to use LSTs as collateral to mint mkUSD, Prisma’s CDP stablecoin, and functions similar to Liquity.

Since their initial launch, Prisma swiftly garnered significant interest, amassing an impressive ~$34M in TVL within hours, subsequently maxing out all four collateral vaults’ debt caps. With the impending debt cap increase, it’s anticipated that this limit will be promptly reached again.

mkUSD has three main utilities: to provide on-chain leverage, to purchase discounted collateral from liquidations through their stability pool, and to earn swap fees and CRV, CVX, and PRISMA emissions.

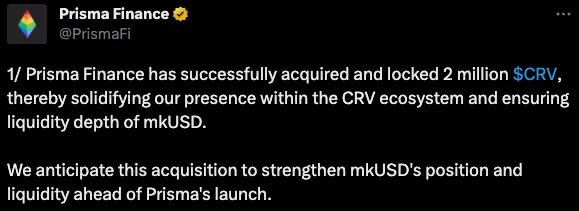

They’ve also acquired 2M in CRV from the OTC sale by Curve’s founder, Michael Egorov. These CRV tokens have been voted to be locked permanently, with voters who approve this proposal to receive a pro-rata share of locked PRISMA airdrop once the token is available.

Currently, there are two main pools on Curve that have been incentivized through directing curve emissions. With the impending PRISMA token launch, the additional PRISMA incentives are projected to enhance mkUSD’s allure.

PRISMA will be the governance token on Prisma, with users having to lock their tokens to receive voting power. Beyond governance, PRISMA will also be used to boost emissions and direct weekly PRISMA emissions.

There will be four ways to earn PRISMA:

-

Depositing to the Stability Pool

-

Minting new mkUSD (with a particular collateral)

-

Maintaining an active mkUSD debt (with a particular collateral)

-

Staking Curve LP tokens

Prisma will be an LSDfi protocol to look out for, given its initial traction. However, the LSDfi market has been rather saturated with multiple protocols like Lybra, Maker, and crvUSD. This makes for a rather competitive market, with yields being the main reason to own these stablecoins.