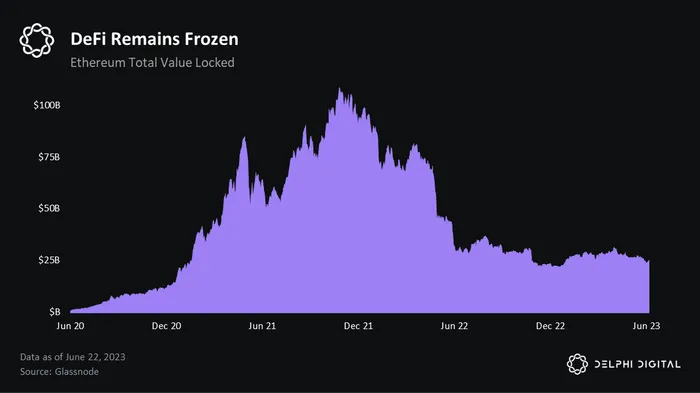

It’s no secret DeFi is struggling these days. Prices are downonly.

And on-chain activity is tepid.

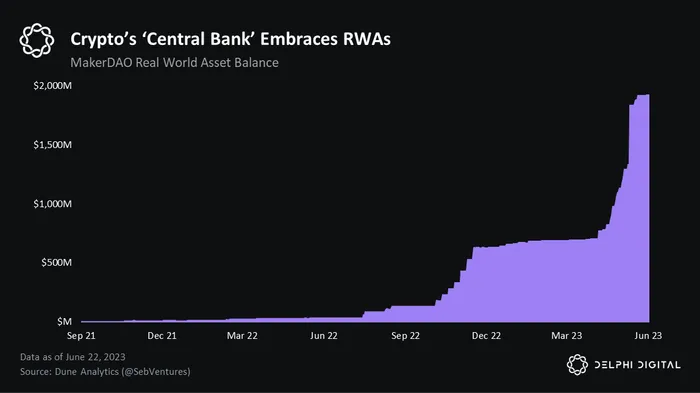

But in one small corner of the DeFi space sumthin is cookin: Real-World Assets (RWAs).

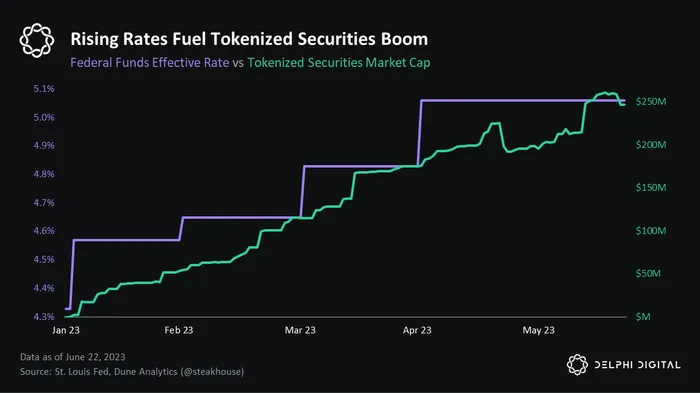

Specifically, RWAs that bring U.S. Treasuries on-chain. This is, of course, all thanks to our benevolent overlords at the Fed.

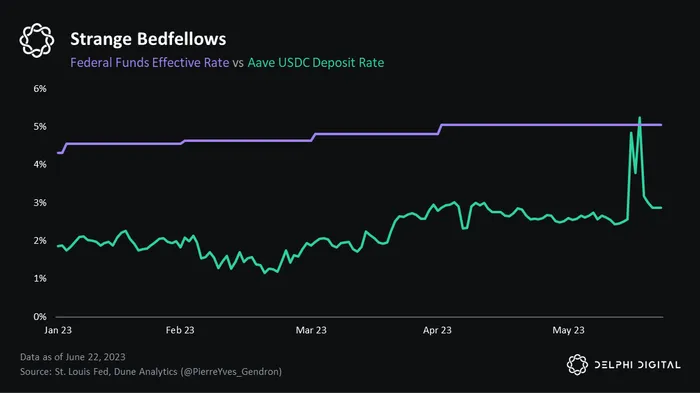

Conveniently, at the same time demand to borrow on-chain has all but dried up, UST yields have ripped due to the Fed’s hiking program.

This has led many a degen into the warm embrace of good ole T-bills.

Now that rates have peaked, err, “paused” per JayPow, it’ll be interesting to watch whether tokenized T-bills stay uponly. Either way, RWAs seem to have already found product-market fit. It’s only a matter of time before the boomers — looking @ you Mr. Fink — wake up to the reality that tokenized T-bills unlock latent liquidity, faster settlement and greater composability. Until then, we accumulate.

As we await Valhalla, which shall be delivered to us by the monetary mandarins at BlackRock, one thing is clear: this Fed hiking cycle has propelled what was once a niche DeFi market product — tokenized T-bills — into one of its premier offerings. It’s a product that’s now being touted as a potential catalyst for the next bull run. Crazy what a few lil bps can do…