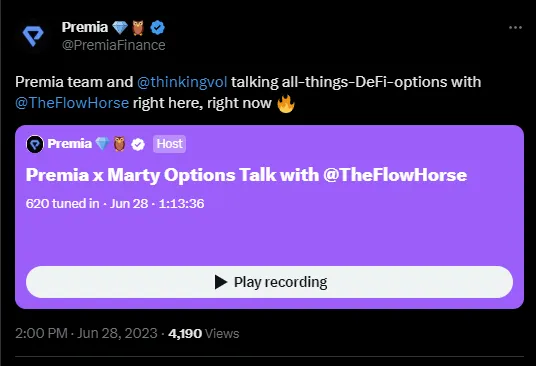

With all the events that have transpired so far in 2023, it might come as a surprise to read that the last 6 months has actually been one of the lower volatility regimes we’ve experienced in crypto in recent years. This can be visualized in the below chart, plotting the BTC DVOL Implied Volatility Index from Deribit against BTCUSD price action.

The BTC DVOL implied volatility index is a measure of the expected 30-day implied volatility of Bitcoin. Very simply put, higher index values indicates that the market expects the price of Bitcoin to be more volatile in the future, and vice-versa for lower index values.

So why has vol been so muted? Thinking back, 2022 was a higher vol regime plagued by one major catastrophe after another with regards to crypto markets (to say nothing of the larger, global factors at play):

-

April/May 2022 brought the demise of LUNA/UST.

-

June 2022 brought the liquidation of 3AC (and sent subsequent shockwaves throughout the institutional crypto space).

-

November 2022 brought the collapse of FTX.

This higher volatility regime came to an end around the same time that these events concluded; with the collapse of FTX (and subsequent easing of global macro factors such as liquidity conditions).

Since then, vol has been largely muted (with the occasional spike, such as on the back of the US Banking Crisis). Perhaps surprisingly, the recent flurry of BTC spot ETF applications has done little to alter the current volatility regime, as we see implied volatility levels back at pre-announcement levels.

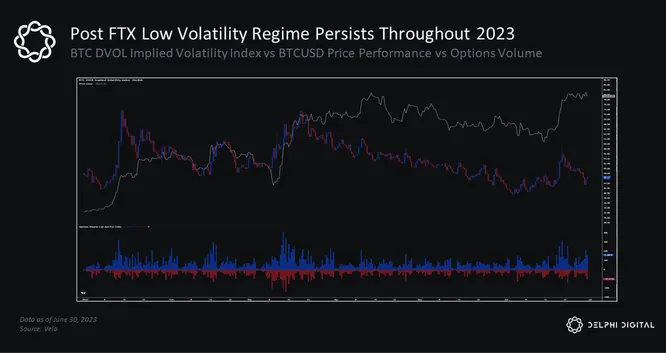

The BTC implied volatility term structure is a graphical representation of the implied volatility of Bitcoin options across different expiration dates. Term structures such as these are used to analyze how the market expects the volatility of Bitcoin to change over time. Please note that as with all types of expectations, market expectations around volatility can change rapidly, so it is important to closely monitor the term structure over time if we are using it in our analysis.

The current term structure indicates that the market expects BTC to remain relatively muted over the next several months, while steadily increasing into year end and throughout the first half of 2024. Based on this, it seems as though our lower volatility regime is likely to continue, at least for a few months.

Interestingly, there are several ‘organic reasons’ for why we may see a change in vol regimes as we head into 2024:

-

2024 US Presidential Election

-

2024 BTC Halving

All of this corresponds nicely with our thesis for risk assets heading into 2024.

Please check out the recent twitter spaces from @thinkingvol, @premiafinance, and @theflowhorse, in which several of these topics are also discussed!