Tether recently announced a record-breaking $5.2B in profit in the first half of 2024. Tether is now on track to generate nearly double Blackrock’s 2023 earnings. For context, Blackrock is the world’s largest asset issuer.

While Tether’s profitability is certainly impressive, it feels antithetical to the fundamental ethos of crypto. DeFi was built upon the principle of redistributing the take rate of rent-seeking monopolists back into the hands of the users — not creating new ones.

To date, however, the current attempts at breaking the back of the Tether monopoly continue to fail. While the idea of redistributing Tether’s profitability back to end users is certainly a compelling idea, none of the existing yield bearing stablecoins (i.e., sDAI, USDM, stUSD) have gained meaningful traction.

Ultimately, I believe this is a function of three structural network effects underpinning USDT:

- Liquidity – USDT is the most liquid stablecoin in crypto. Using some emerging USDT competitor implicitly assumes taking on more slippage, especially for larger institutions and whales.

- “Denomination Effect” – Almost every major trading pair on both CEXs and DEXs are denominated in USDT. USDT is also a preferred quote assets on money markets.

- Payments – USDT is increasingly being used as a form of payments in emerging economies. The network effects associated with being a digital medium of exchange are arguably the strongest.

While these network effects are often attributed directly to Tether, counterintuitively, they are downstream of the application layer. In other words, without the exchanges, money markets, wallets, and payment apps integrating USDT, USDT would have no utility. Put simply, Tether derives its value from applications, not the other way around.

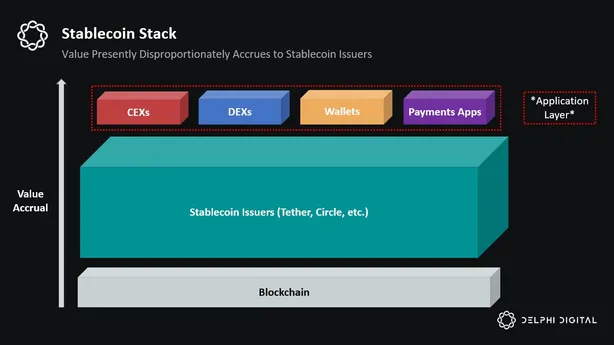

We can visualize the stablecoin stack composed of two primary layers: (1) stablecoin issuers and (2) stablecoin distributors (i.e., apps). Presently, the distributors disproportionately create value for Tether, yet they capture none of it.

This likely explains why yield-bearing stables have yet to compete with Tether – there is simply no incentive for apps to integrate emerging stablecoins given they do not get a piece of the economics.

While “points” can serve as a short-term incentive, there seems to be no longer-term incentive to steer users toward using alternative stablecoins. In fact, unwinding the network effects associated with using USDT as a quote asset, accepted collateral, or medium of exchange for payments would actually undermine an application’s competitiveness.

Therefore, by trying to win over the end user without aligning the incentives at the application layer, yield-bearing stables seem to be fundamentally playing the wrong game.

How M^0 Re-Architects The Stablecoin Stack

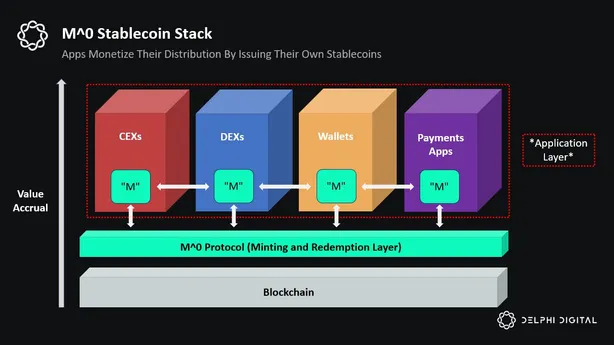

M^0 is taking a different, and in my opinion the directionally correct, approach at breaking the back of the Tether monopoly. Instead of focusing on the end-user, M^0 caters their value prop to the applications given they are ultimately the distribution channel for stablecoins.

The way M^0 accomplishes this is by serving as a thin credibly-neutral settlement layer that enables any application to mint and redeem “M”, a fully fungible stablecoin overcollateralized by treasuries (other eligible collateral may be added in the near-future). This model has three structural advantages over the USDT model.

First, applications opting to integrate “M” will earn a large share of the yield generated by the treasuries. This effectively enables applications to monetize their distribution simply by integrating “M” as the canonical stablecoin within their ecosystem. At scale this could be a meaningful revenue source and possibly even the principal revenue source for larger apps. This serves as a strong structural incentive to integrate “M”. Apps could also redistribute some of this yield back to end-users as well.

Secondly, given that “M” is minted and redeemed on a unified settlement layer (i.e., the M^0 protocol), all “M” is fungible with one another. Presently, the only way for an app to capture stablecoin yield is to independently spin up their own stablecoins from scratch. Not only is this operationally challenging, but it would be difficult to get other apps to adopt this stablecoins standard. M^0 serves as the best of both worlds by giving applications native stablecoin yield while concurrently maintaining composability across other apps.

Third, M^0’s custody solution offers several key advantages over other stablecoins. Unlike centralized stablecoins where a single entity controls the collateral, M^0 has a network of independent validators fostering a more decentralized and transparent system. Collateral is also held in off-chain eligible custody solutions, which are structured as orphaned special purpose vehicles (SPVs) in approved jurisdictions. M^0’s novel Two Token Governor (TTG) system also enables decentralized governance over the custody parameters, allowing the system to adapt to changing regulatory environments.

It is lastly worth noting that M^0 describes “M” as “credibly neutral raw material for value representation.” Accordingly, “M” can be used as far more than simply a stablecoin. In theory, you could see other stablecoins allocate some of their collateral backing to “M” to further diversify their custody risk. Additionally, you could see a world where “M” serves as reserves for a neo-on-chain fractional reserve banking system. While this future certainly hinges on regulatory adoption, given “M’s” inherent credible neutrality, it could be a logical choice for banks and other institutions looking to take advantage of the settlement speed and efficiency gains that blockchains provide.

In summary, M^0 flips the existing stablecoin stack on its head by allowing apps to monetize their distribution over stablecoins. Given the structural incentives for to integrate “M” at the application layer, I believe M^0’s design could be one of the best contenders for challenging the Tether monopoly and fostering a more decentralized and democratic stablecoin ecosystem.