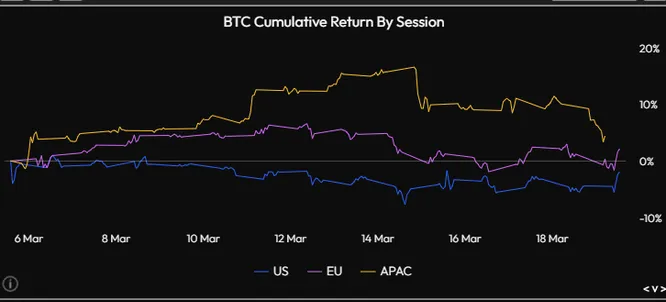

GM – hopefully this post finds everyone safe in the aftermath of this most recent market pullback. While these moves may feel painful in the moment, they are very natural and healthy parts of a longer term bull cycle. They can even provide clues and hints towards what the market will care about most when the general uptrend continues. Everyone has been looking at the ‘froth signals’ within crypto markets like memecoin mania, the absurd pre-sale meta, etc. And while there may be some truth to this, there are some larger, more important factors at play. Specifically ETF flows.

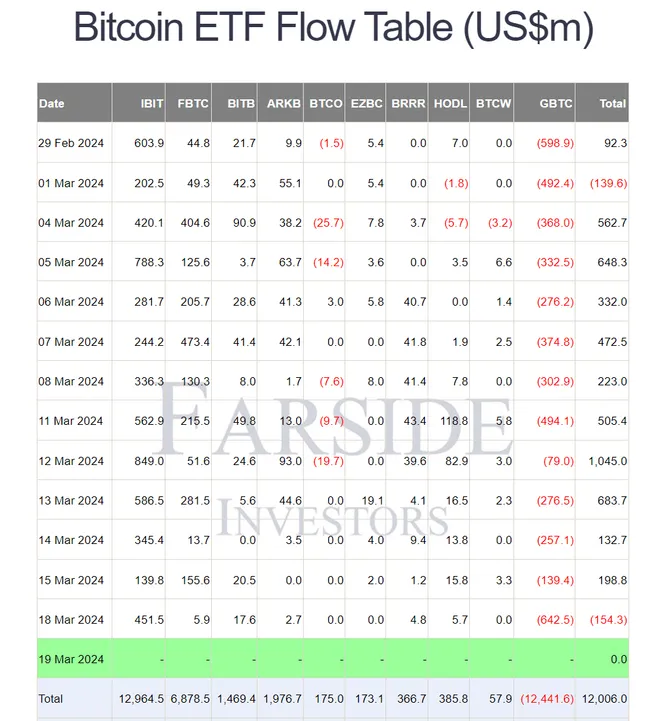

Over the last several days we have seen net ETF flows taper off gradually, culminating in the first net outflow day since March 1st. This was largely a result of 642M in GBTC outflows, the largest single day outflow we’ve seen since the ETF products went live. IBIT was able to offset a large portion of these flows, contributing 451M on the day.

Right now it is obvious that flows are king and the market is heavily weighing these numbers. We’ve even seen it in intraday trading dynamics as market participants attempt to front run these flows.

It will be important to watch these daily flows, as well as any changes that might impact GBTC outflows (perhaps GBTC eventually cuts fees to stem the AUM bleed as they’ve alluded too). At the current rate of about 200M outflow per day, GBTC selling can sustain through July.

That said, funding levels have reset quite dramatically over the last few days, resembling a much more healthy environment compared to what we’ve seen recently.

We’ve seen BTC put in a local low (for now) around the $62K level, marking about a 15% drawdown from current highs, before rallying back towards $65K. .

During this rally, we have seen impressive outperformance in a few names, specifically the “ALT L1 Trade”. For those of you who were here last cycle, we saw a similar trade unfold, coined SOLUNAVAX.

It appears as though the market may hinting at what it ‘cares about most’. Expect to see many threads and twitter spaces telling stories and spinning narratives around this basket of names as prices continue to rise. Remember…. price always precedes narrative.