I am generally not great at timing markets, so I don’t trade. I buy long-term spot positions instead. My emotions run wild when prices soar, and I do not want to sell the higher everything goes. When prices fall, I feel the need to sell everything. Trading is miserable. However, there is one top-ish signal I have trained myself to recognize and have built reminder systems to reduce exposure when I see it – meme coin pumps.

I define meme coins as cryptocurrencies with no broader utility than hype – Shib, Floki, Baby Doge Coin, Mona Coin, whatever. They are all meme coins. On a side note, I no longer consider Doge a meme coin – it is now a Musk coin. Musk controls Doge price action. I have no issue with meme coins per se. Speculation is a healthy market activity, a lot of fun, and attracts users.

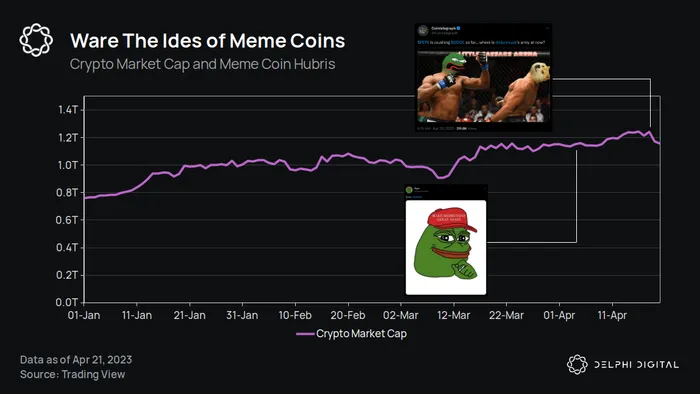

The latest meme coin is $PEPE. Created on April 4th, $PEPE exploded into popularity, with its Twitter account gaining 55K followers in less than three weeks. Pepe branded itself as a meme coin to supplant dog coins and advertised itself with all the usual ‘pumpy’ terms: no presale, zero taxes, burnt LP, and a locked contract. In two and a half weeks, $PEPE went up 26,000%. Following $PEPE’s success, more meme coins entered the frothy market, and millions of Twitter accounts were shilling them. Coin Telegraph, an account with 1.8M followers, tweeted an image of $PEPE knocking out $DOGE. Note the price action afterward.

The meme coin hype triggered my ‘meme-coin pump’ signal, and I sold some spot positions before today’s sell-off. My ‘meme-coin pump alarm’ is not always accurate. Price action is determined by much more than low market cap coins. But for me, some caution is always warranted when meme coins start popping off.