Growing up I really loved the movie The Matrix for the action packed scenes of Neo dual wielding machine guns or Trinity jumping out of a skyscraper only to be shot on her way down. That trio went so hard.

As I got older I realized the movie is really about choice and free will. It’s about escaping the techno-capitalist machine that decides our every action without us even knowing it.

A new Crypto x AI project that has been in the making called Morpheus launched the first step of its release with a fair launch. The pool has attracted 60,000 stETH ($165M) in a matter of a week, but I’ll get back to that.

The vision for Morpheus is sort of similar to Bittensor, Allora (UpShot’s successful new era) in being a coordination network that incentivizes the creation and use of new AI services on one side and allowing users to access these services on the other. Morpheus, like others, fit into my thesis on providing the antithesis of “OpenAI”. The quotes are because everything about OpenAI is closed off. Someone being able to control a single foundational model, and augmenting the 3 million GPTs built atop it servicing users, to alter society should scare you, it scares me.

Also, the board controlling OpenAI before Sam and crew took back control were not the leading AI researchers of our world. The media joked that Joseph Gordon-Levitt’s wife was on the board, but I mean they are right she was. She has plenty of her own accomplishments but not who you would expect to be on the board controlling OpenAI.

To walk through an example, the end-vision for a network like Morpheus is you wake up and you open your personalized AI app. You decide hell I really want to change the range of liquidity I’m providing on Uniswap for the MOR/USDC pair, so I’ll call (inference) a large and smart uniswap liquidity provision model to handle the details for me. I simply type in my request to the chatbot, and a network of hard tech behind the scenes (Uniswap AI model, solvers, MOR rewards for this model creator) handles the rest. Now I want to know why you would do this pre coffee, but that’s on you anon.

I put together a more specific flow of how I understand the network below.

While a little complicated, one of the things I like about Morpheus is the network gives out its tokens programmatically to the services that are handling the most inference requests. So if a service is really being used, it earns more of the tokens from the network’s daily compute budget. For deeper reading, check out Erik Voorhees’ Yellowstone paper here (and my Github comments here).

This is in stark contrast to Bittensor’s proposed incentives that hand out tokens to each subnet (think different AI services in larger buckets like an image generation subnet) based on the value of that specific subnet token. While a model that pays out based on usage vs staked value or overall price has its own issues, it allows for smaller players who create the best services to bubble up to the surface vs being blocked by whales who can bid up a service or subnet so tokens simply flow there. Leaning into the creative innovation side and rewarding the long tail is how we tap into the largest bucket for creative innovation.

I want to put Morpheus on people’s radar given ideologically I agree with the focus and makeup of the network.

Hold Up, Let’s Talk Through Some Concerns

Despite the hype of Crypto x AI, It’s always worth taking some caution. Morpheus is obviously in the extremely early days of its life. There are no real AI services that you can currently use, and the main focus right now for better or worse is on the bootstrapping pool. There are glimmers of services though, with a local LLM design being showcased.

Morpheus’ token econ rewards 24% of tokens each to community, capital, compute and code pools and the remaining 4% for the protection fund. These pools are rewarded semi-programmatically over the next 16 years.

The bootstrapping pool allows users to give stETH (it’s not sold) and give up the yield from that stETH which will buy MOR to bootstrap the AMM pool. In return, users get access to their pro-rata amount of tokens from the capital pool. Now the amount of MOR tokens for one’s stETH is low (think 24% of tokens over 16 years means over 90 days its a slim amount) with the flip side being you’re not selling your stETH.

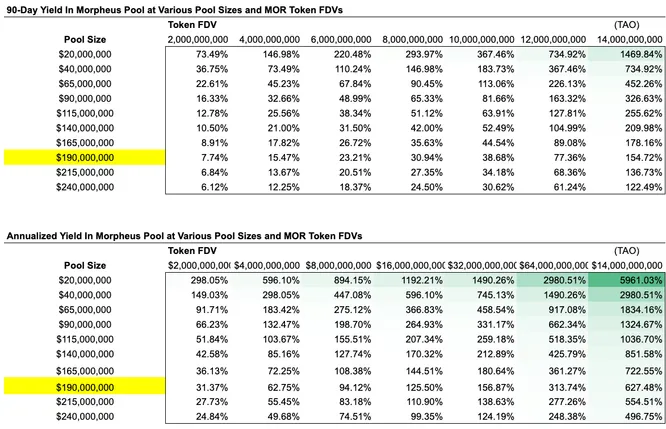

Below you will find the 90 day, and annualized, yield for the MOR bootstrapping pool. In yellow I’ve marked where the pool currently sits in TVL on the left and on top I’ve marked Bittensor’s current market cap to compare yields.

On one hand, yields are not very attractive. On the other hand it is the only way to play Morpheus and could demonstrate more tokens saved for a longer term project. Users are able to withdraw their stETH starting in a few days, so the pool is not locked and TVL will vary.

Other concerns I would note are that token allocations to code, community and coder buckets are currently manual but are being done in a relatively transparent fashion. See here for the Github on current code providers that will be rewarded.

The other concern we were waiting on was a transition from an end user account to a multisig for the pool. When the pool initially launched it was not controlled by a multisig, but this transition to a multi has been completed.

Coordination Networks

At the end of the day, Bittensor, Morpheus and others are incentive coordination networks. The end goal is to provide the most rewards to the most cutting edge AI services that users desire. This comes in the form of bringing your own model, or fine tuned model or AI service.

One of the hardest problems to solve for these networks is choosing which model to use in a world of millions of models. If a user request for a crypto trade hits the network, do I route it to Cowswap or Uniswap or DeFillamma? One level deeper, whose trading model for uniswap specifically is the best?

There are some solutions here. NOUS research built a service (Bittensor subnet) that model creators can submit their models to. These models are trained against synthetic data to gauge their commercial viability for different use cases. TLDR, these Crypto x AI networks need to address one of the hardest problems of deciding what model to use, and when. The end services can be crypto in nature, or outside of crypto.

Under the guise of attracting developers and closer to the end user, other projects like MyShell.AI drop the barriers to create an AI chat bot to close to zero. You can choose your own centralized or open source foundational model, fine tune it with data and release it publicly or privately all with crypto incentives.

Conclusion

I’m a strong believer that AI is the most powerful technology of our lives and it should live in a transparent manner and be owned by the people using Crypto as its backbone and incentive layer. Morpheus is an exciting project at this intersection. Less ideologically, I think the crypto flywheel with AI will suck in the best developers and models to earn, grow their capabilities and maybe beat out centralized services.

Like many early stage projects it requires a jump, or risk, that those creating AI services and use cases will deploy them on the network. It’s a situation where you’re betting price makes the tech better.

I’m really excited at the intersection of Crypto x AI, and we’re actively researching the sector. If you know of someone building something cool here, please reach out to Delphi Ventures.

Disclosure: I am long both TAO and am in the MOR stETH pool.

____

2/16/24 Edit

Hi everyone, I just wanted to call out one error in our table.

Our table shows a TAO (Bittensor) FDV of $3.6B. This was commonly shared on Twitter and Coingecko originally had this as the wrong value. The actual FDV right now is $14.5B. Coingecko has fixed this issue.

Thus yields on our original table understate the APYs comparable to TAO. We’ve added an updated table below.

This yields are strictly educational and may not even remotely happen. Its supposed to showcase yields vs a spectrum of FDVs toward TAOs.

Link to coingecko fixing the error here: https://x.com/bobbyong/status/1758485319148855664?s=20