Earlier this week, Tesla held its annual shareholder meeting, aka the 2023 Cyber Roundup in Technoking parlance.

When Elon talks, it’s usually interesting. And the shareholder meeting was no exception. Aside from his standard semi-awkward jokes, brazen brags, and various other idiosyncrasies, Elon shared a surprising amount of color on the “challenging” global macro environment.

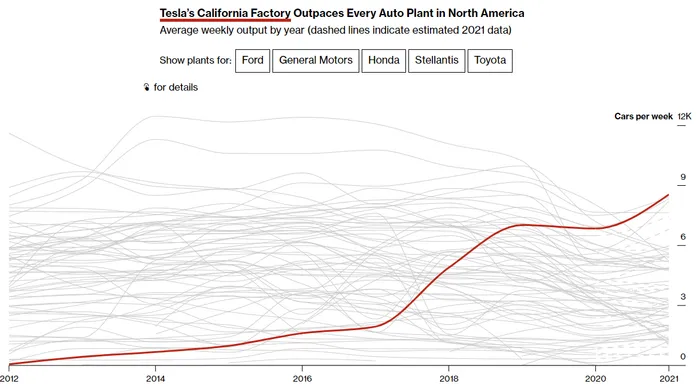

By virtue of being the world’s largest EV maker and one of its largest manufacturers period, Tesla has a lot of valuable data to share on supply chains, business activity and consumer demand.

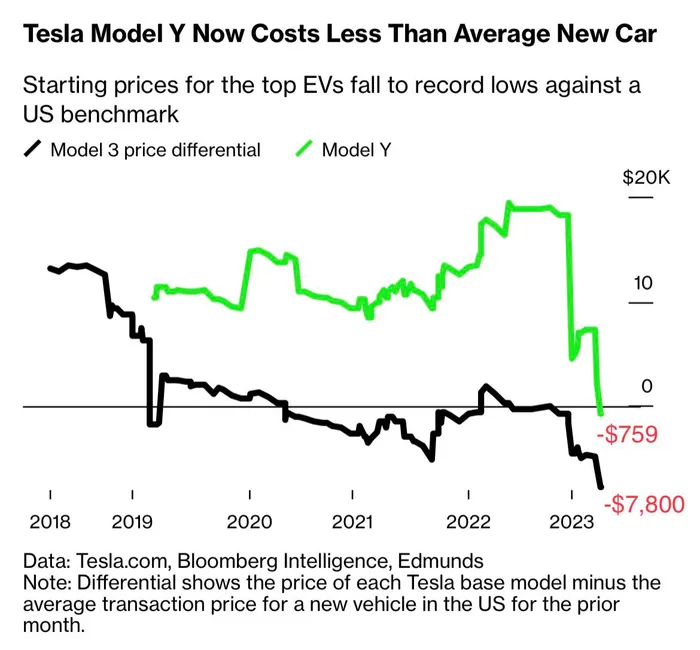

The timing of the shareholder meeting was also intriguing as it comes amid a price war incited by Mr. Musk himself.

Tesla’s price cuts, which have roiled the auto industry, could be a response to three dynamics:

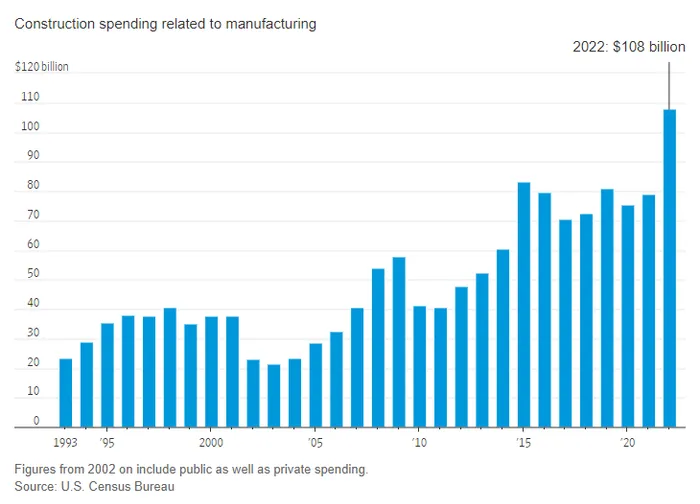

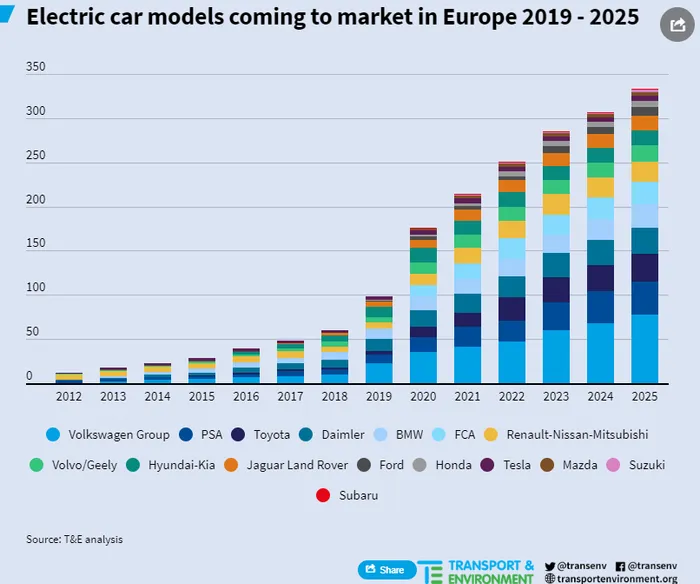

(1) Traditional automakers are ramping up their EV investments…

…and Tesla — with its limited selection of just four models — is probably feelin the competitive heat to differentiate on price.

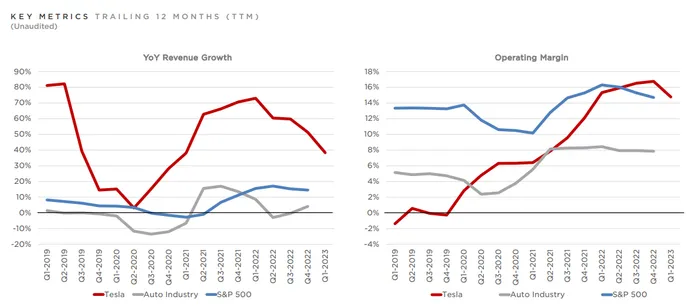

(2) Tesla enjoys a commanding lead over its competitors on a unit economics basis.

In fact, Tesla actually makes money on the vehicles it sells — a feat Ford has struggled to replicate. In Q1, Ford lost an average of $58,333 per EV sold.

Remarkably, even unprofitable Ford responded to Tesla’s massive markdowns, announcing a ~$4,000 cut Mach-E prices.

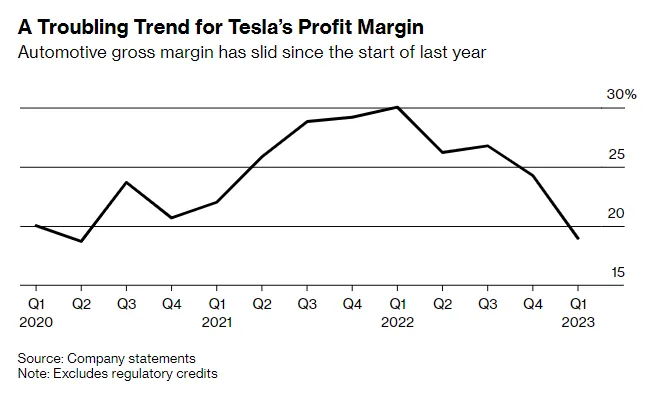

As competitors’ capex balloons and PnLs remain deeply negative due to soaring EV costs, Musk likely smells blood in the water and is willing to bleed some margin in order to see competitors bleed an order of magnitude more margin.

(3) The third — and by far the most concerning — potential driving force behind TSLA’s self-inflicted price war is weakening consumer demand.

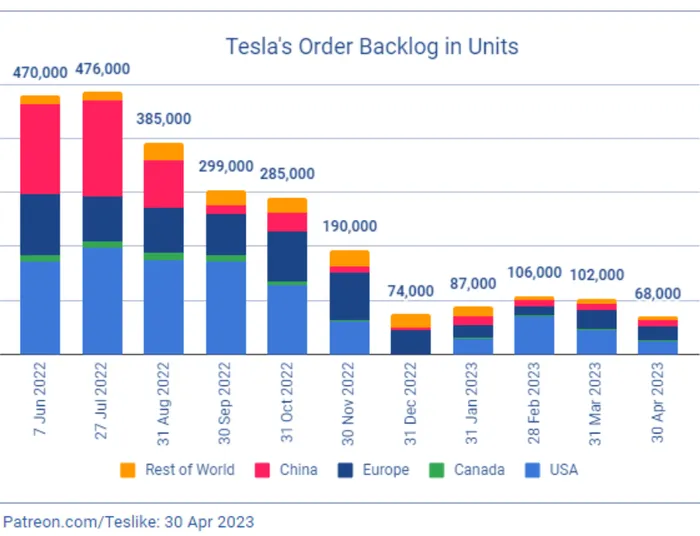

For much of its corporate history, Tesla has been supply constrained. Demand has always outstripped supply. That is, until now.

Just the other week, @TroyTeslike, a highly followed Tesla analyst on Twitter, posted Tesla’s estimated order backlog showing it now has a 68,000-order backlog — a fraction of the 476,000 from a year ago.

A shrinking backlog paired with rising inventory suggests Tesla is having a more difficult time selling its vehicles. When concerns of this ilk would come up in the past, Elon would always argue that consumer demand is a function of price. He’s said that while some people might not want a Tesla for $50,000, many would for $35,000.

This makes sense on some level. After all, Tesla is the category winner — the Apple of Detroit’s eye — and its focus on EVs has borne fruit with its industry-leading margins. Put bluntly, Tesla makes more schmoney per car than every other automaker in the world.

However, just because Tesla can afford to bleed margin doesn’t mean it should. Elon freely admitted this during the meeting, calling it an unorthodox strategy but the right one because so much of Tesla’s future value lies in Level 5 autonomy.

The thinking is that each Tesla car will, over time, become a sorta Amazon Prime subscription on wheels — a critical piece of digital infrastructure that the masses will happily add to their monthly credit card bills. Here, Elon is prioritizing market share over moolah.

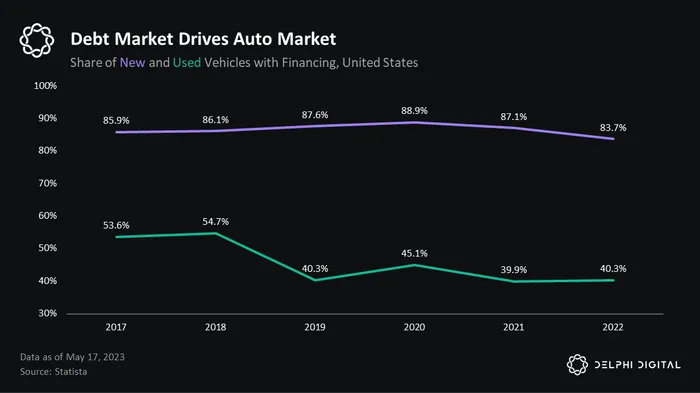

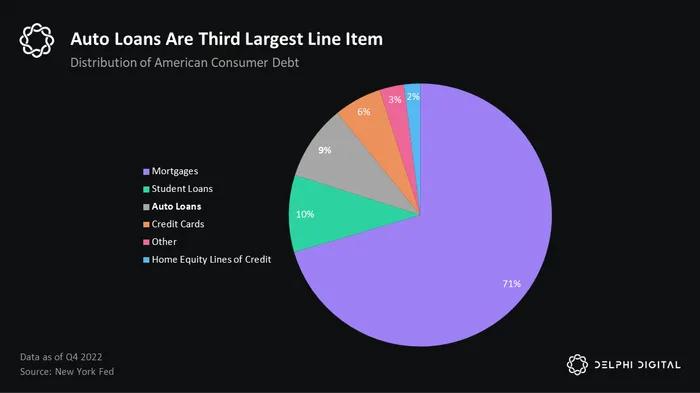

Later in his remarks, Elon went into detail on how a car’s sticker price is not actually as central to the yes/no decision as many think. Instead, it’s influenced by more boring, less malleable inputs like the Federal Reserve’s interest rates, credit impulses, and consumer health.

To watch Elon’s full remarks, check out this YouTube video. Direct excerpts from Elon follow below, with charts included by yours truly.

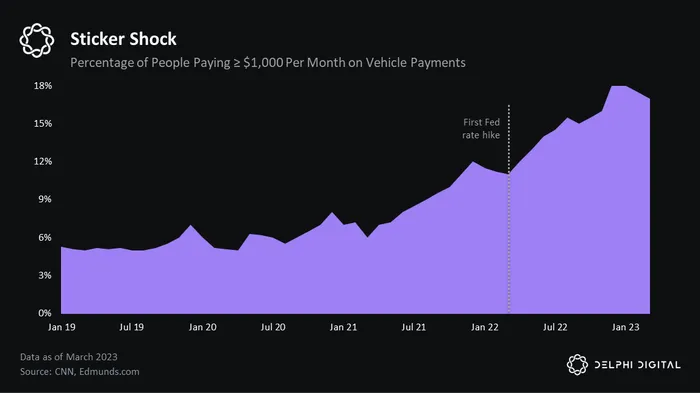

“Interest rates have a very big effect on the affordability of cars.”

“The vast majority of people buy cars based on the monthly payment.”

“So it’s, like, how much is the monthly payment? And it’s not a question of value for money; it’s just do they have enough money? Can they afford it?”

“So for the vast majority of people, it [comes down to whether] they can afford to pay the monthly payment.”

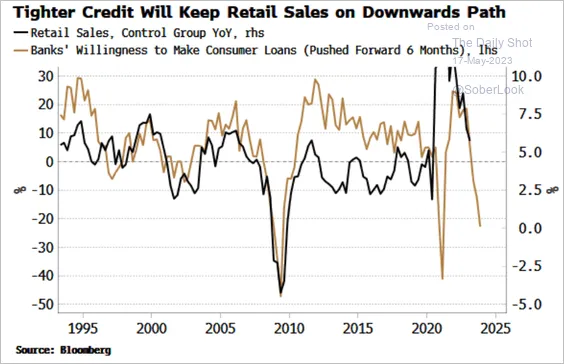

“As interest rates increase and credit tightens, [financing a new car purchase becomes more expensive].”

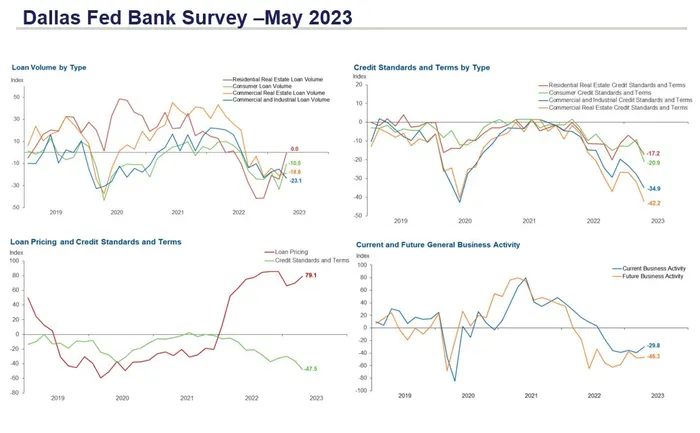

“It’s safe to say that these various banks that died are probably somewhat distracted from handing out auto loans. ”

The Dallas Fed’s May Bank Survey shows loan pricing [bottom LHS] jump and lending [top RHS] continue to tighten across the board

“This is going to be a challenging 12 months; I want to be realistic about it.”

“Tesla is not immune to the global economic environment.”

“I expect things to be, at a macroeconomic level, difficult for at least the next 12 months. I think we’ll see a lot of companies go bankrupt.”

Bloomberg chart as of May 15th