So far, 2023 has been a great year, and one of reprieve for risk assets in the wake of what can only be categorized as a catastrophic 2022. Murmurs and echoes of ‘we’re back baby’ have been heard floating through social media circles.

With April now in the books, it makes sense to take a look at risk markets to see where things are as we head into what is often known as the ‘Summer Doldrums’.

At the time of writing, the SPX finds itself at a pivotal area (similar in context and structure to BTC at $30K area). As I’ve said many times in the past, I consider the SPX to be rangebound until we see some kind of acceptance above 4250ish, or below 3650ish, and still consider this to be the case. Yes, even with how bullish the above chart looks…

In the event that either of these two scenarios occur, it would signal a clear break from value (obviously we would evaluate many other factors should one of these scenarios begin to occur).

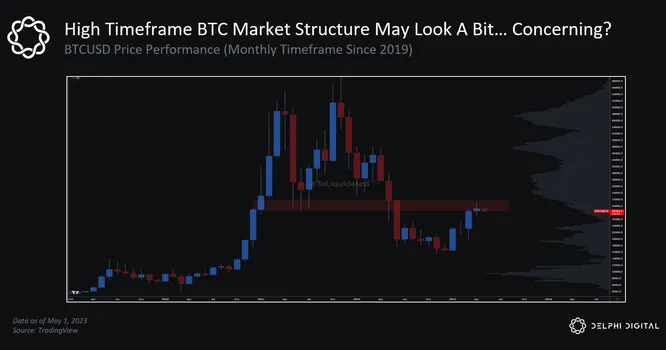

On the other hand, the higher timeframe monthly BTC chart is a bit less bullish as we approach the bull market range lows.

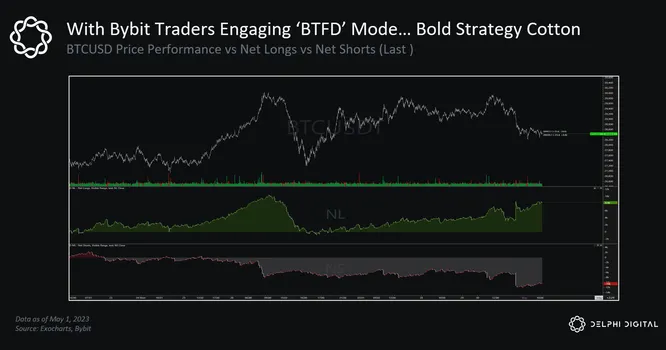

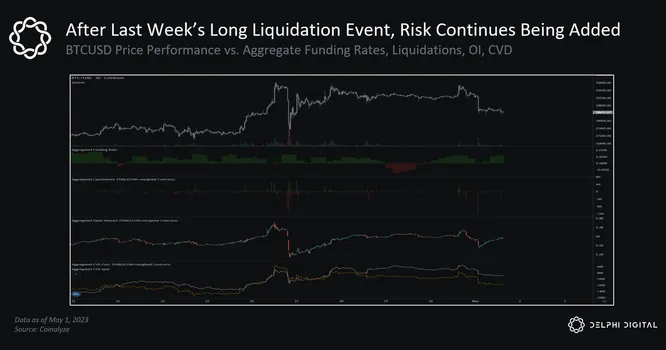

As we already know, no good rally will go unpunished with Bybit traders getting extra exposed at the extremes. Bybit long exposure has taken no time in returning back towards the pre-liquidation levels of last week, re-engaging BTFD mode.

In fact, we have seen this dynamic (albeit a bit more muted than on Bybit) across the broader market. Caution is likely warranted, so instead of having a directional bias, I encourage you to simply become an enjoyooor of markets.