Leading ETF analysts at Bloomberg Intelligence have raised their probability of a spot BTC ETF approval to 65% in light of recent events (mentioned in tweet above).

Notably, they also believe “the path of least resistance is simultaneous approval for all 8 filers + Grayscale in the aftermath of the courts vacating the SEC’s denial.”

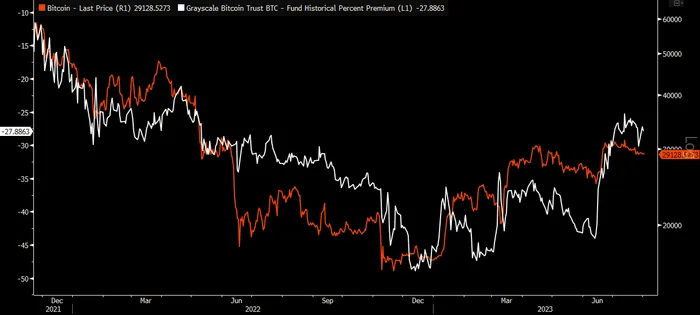

We’ve been monitoring the GBTC discount as a proxy for market expectations (and timing) on the Grayscale case, which hasn’t moved much since mid-July despite growing confidence that the SEC can in fact be defeated (CBOE ruling on July 28th being the most recent example).

The likelihood of an ETF approval by EOY is still uncertain, and there’s no shortage of expert opinions to go around. The argument for simultaneous approval makes sense – that way the SEC isn’t portrayed as picking favorites at the expense of healthy competition.

The likelihood this plays out by the end of the month though is probably nothing more than wishful thinking. But for those looking to take a flyer on a quick domino-effect approval, Polymarket is offering a relatively cheap call option on a swifter-than-expected outcome.