I’ve been tracking Blur since October 2022. During this time, my thoughts have evolved many times.

Today, my BLUR thesis is simple.

If you believe that:

1. Market cap for NFTs will expand hugely in the future

2. There’ll be another speculative bull run for NFTs in the next 1 – 2 years.

Then BLUR is essentially the only way for most people to bet on and capture the upside from this specific future happening. Buying individual NFTs requires picking winners and avoiding losers.

There are very few other fungible tokens that capture the broader NFT market — the next one could be TNSR (Tensor). However, there is still no info about its tokenomics or token launch date, and the only way to obtain future TNSR is to provide liquidity on Tensor or stake Tensorian NFTs.

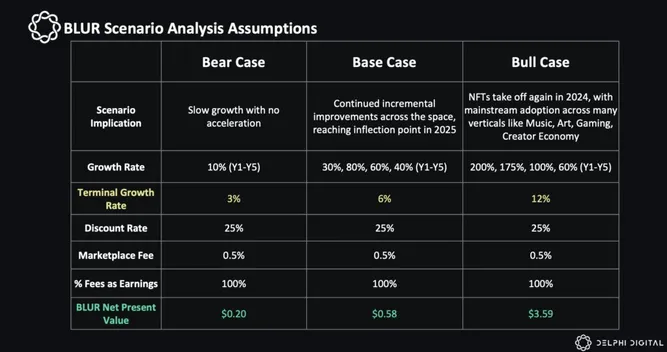

We’ve written extensively about Blur and its fundamentals over the past year in our Delphi reports, including a DCF analysis based on bull/base/bear scenarios for the NFT markets.

At the end of the day, though, I believe the math (e.g., trading volumes, revenue) doesn’t matter as much. It’s because our crypto industry is so nascent. Blur is barely in its 2nd year of existence. My mental model on tokens like BLUR is that they function as tradable call options for the future growth of a protocol. Very different from publicly traded stocks.

So it’s worth sizing your position according to your level of conviction in the two beliefs above.

One final observation: OpenSea was valued at $13B during its Series C fundraise in 2021. BLUR is the market leader in its segment today, and it currently has a circulating market cap of $840M and a fully diluted valuation of $2B.