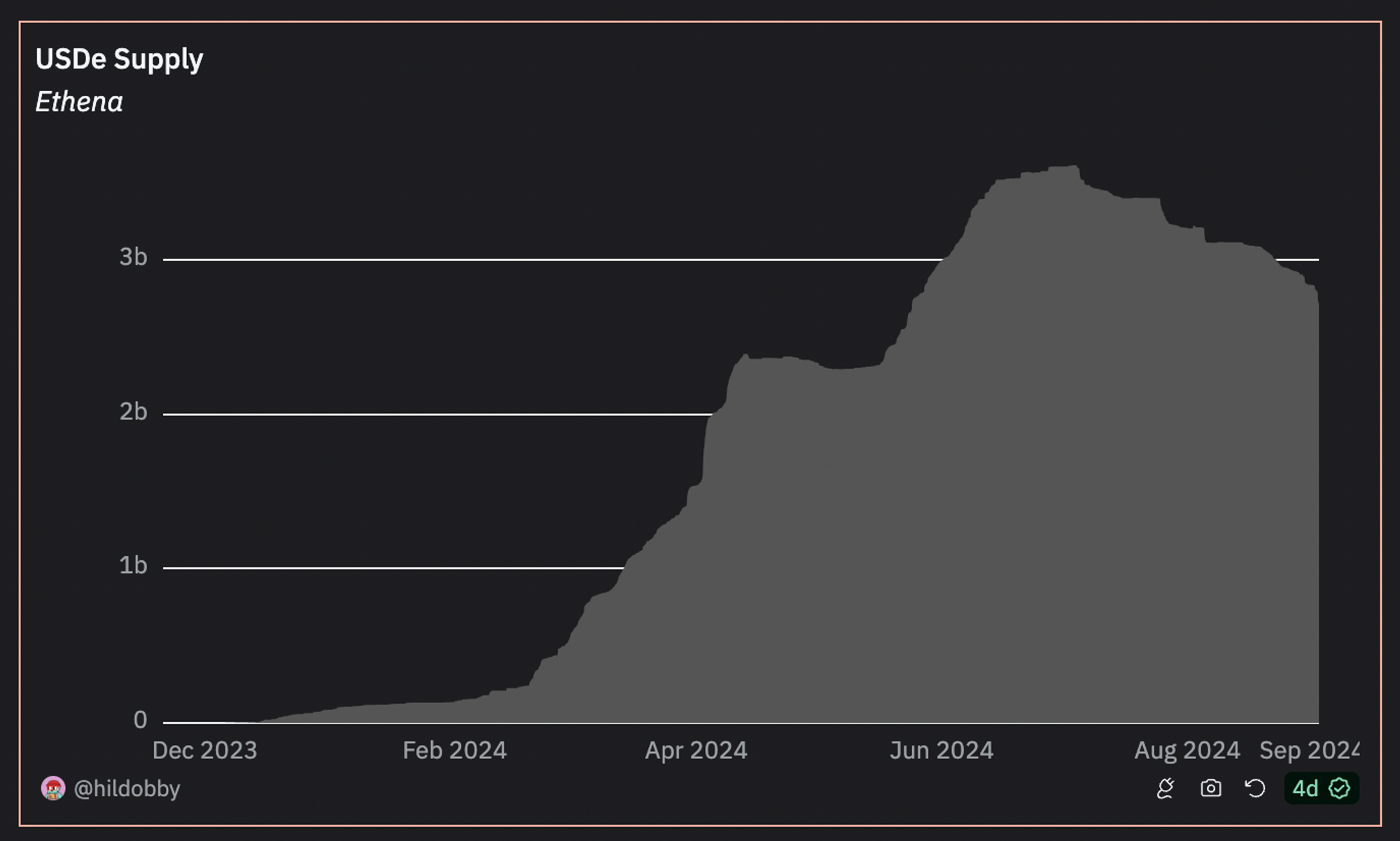

One of the big wins of DeFi in 2024 has been the tokenization of the widespread “Cash and Carry” trade as the synthetic dollar USDe by Ethena Labs. USDe supply has ballooned to $2.7B within 10 months, and the protocol has crossed $100M in fees collected.

A huge opportunity exists to bring such essential but proven trading strategies from TradFi into DeFi. Which strategy do I believe is poised to become the next major winner within this category of products?

With the number of mentions and discussions around the movement of the SOL/ETH and ETH/BTC ratios on CT – I believe allowing users to trade these ratios onchain should unlock a massive influx of trading volume. Trading these ratios (i.e., the relative movements of these asset prices) is similar to Pairs Trading in TradFi.

How Does Pairs Trading Work?

Pairs trading involves taking opposite positions in two correlated assets to profit from the relative price movements. There are two popular sub-strategies:

- Statistical approach: Focuses on mean reversion in prices between the two heavily correlated assets. This approach does not rely on the overall market direction to generate returns and allows traders to potentially profit in various market conditions, including bullish, bearish, or sideways markets.

- Narrative-driven: Going long on the asset expected to outperform and shorting the one expected to underperform. For example, if a trend favors Solana over another Layer 1 token, e.g., ETH, a potential trade would be to go long on SOL and short on ETH, possibl