ParaSpace, an NFT money market protocol, aims to close the gap with its main competitor, BendDAO, by offering more attractive terms for borrowers and greater flexibility for both lenders and borrowers. By lowering its base interest rates, ParaSpace stimulates borrowing and makes loans more affordable for those seeking to leverage their NFTs. Furthermore, ParaSpace differentiates itself by supporting a variety of tokens, not just limited to ETH, as BendDAO does.

A side-by-side comparison reveals that ETH borrowers enjoy a lower base interest rate of 15.9% on ParaSpace, compared to BendDAO’s 29.11%. However, it is important to note that BendDAO compensates for this by offering a token incentive, which ultimately gives them an edge with a net borrow APR of just 11.07%.

ParaSpace’s increased flexibility and lower interest rates have spurred its growth in Total Value Locked (TVL), closing the gap with BendDAO. Currently, ParaSpace boasts $110M in TVL, while BendDAO holds $172M. This disparity is expected to close as ParaSpace offers more attractive terms for borrowers and higher lending interest rates compared to money markets like Aave and Compound.

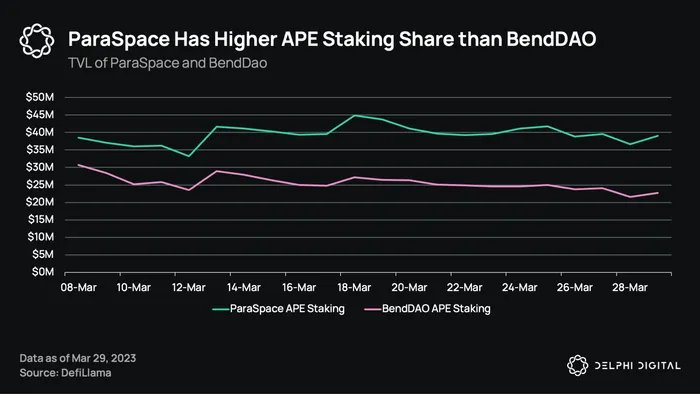

In addition, ParaSpace competes with BendDAO in their APE staking product, where it leads in TVL. Although both platforms employ APE pairing strategies to enhance staking yields, ParaSpace offers a distinct advantage with an APE borrowing pool. This pool allows BAYC, MAYC, and BAKC stakers to borrow instantly and stake without waiting for pairings. ParaSpace also features auto-repayment for APE loans, which helps reduce compounding loan interest and allows borrowers to decrease their loan balance over time. This automated repayment process saves borrowers on gas fees, as they don’t need to execute transactions to repay loans. Moreover, ParaSpace does not charge fees on yields, unlike BendDAO, which imposes a 4% fee.