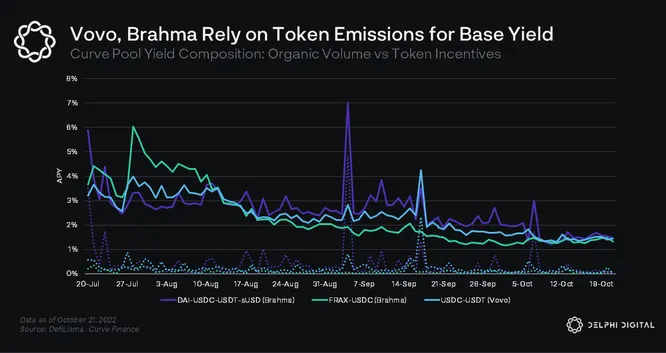

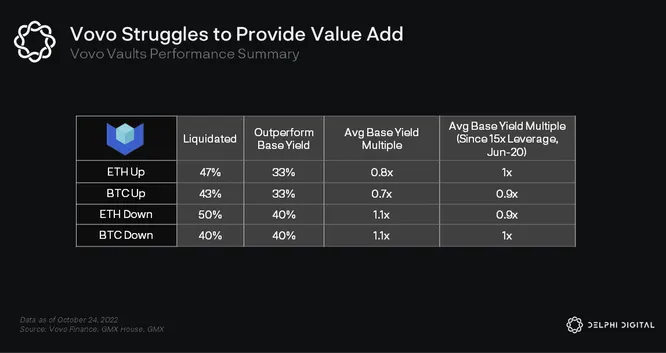

Vovo Finance just announced they are sunsetting the platform. In The Emergence of Principal-Protected Yield in DeFi, we found that principal-protected vaults were all struggling, but the design showed promise. At the time, Brahma had the most value-add, while Vovo failed to surpass the base yield provided by farming CRV.

I find this news unfortunate, because Vovo was working on a cool and unique product, not just a frothy fork on a random chain. Most disappointing to me is that it seems the integration space for these vaults is finally starting to open up, both for the base yield vehicle and surplus yield vehicle.

Base Yield: Ponzu – I’ve been a pretty vocal opponent of veToken shenanigans propping up inferior tech. I’d much rather see resources dedicated to stuff like Arrakis, Gamma or Revert Finance. That being said, one of the coolest aspects of Vovo/Brahma’s design is how they systematically and unapologetically punish these mechanisms.

Camelot and Velodrome are younger, less mature projects with similar token models. It is possible these newer, more improperly priced tokens could juice the base yield, with little change to existing architecture.

Base Yield: Real – DeFi yields are in a much better spot now than at the time of the report. Lyra, Gains, IPOR, and several other projects offer more respectable yield in the 7-10% range. Incorporating these would involve venturing slightly farther out on the risk curve, but would give the vaults a lot more flexibility with the surplus vehicle. Admittedly, periodic harvesting with some of these designs could be difficult to implement, which was one of the benefits of CRV farming.

For this reason, Vovo could deposit to fixed rate lending protocols like Notional, Pendle, etc. Selling the yield forward and carrying on with the surplus yield strategies. Such a system should be more similar to CRV farming, as the ZCB setup could continuously roll over while coupons are collected.

Surplus Yield – Vovo’s yield boosting method of choice was 15x leverage trading on GMX. As we discussed in the report, this is pretty zero-sum in nature. It carries niche portfolio management benefits in a hyper-mature DeFi, but functioned as a gadget in today’s ecosystem.

Recent trends in mechanism design (Synthetix perps v2, GMX v2, Thales, etc) involve discounting positions that help the protocol manage its risk. Purchasing opportunistic positions like this could make the surplus yield more sustainable and +EV. Brahma Finance appears to be in the best position to capitalize on this, since it already uses a hedge fund style algorithmic trading technique. If principal-protected vaults were to acquire enough capital, they could benefit fixed rate lending protocols on the base yield side and hedging AMMs/vaults on the surplus yield side, potentially earning bonus yields or additional discounts from the integrated projects looking to attract timely assistance.

Principal-protected vaults will have their time. There are many levers to pull that could make them very interesting. Vovo pioneered this design, and certainly belongs in the elite tier of DeFi’s deprecated projects. RIP