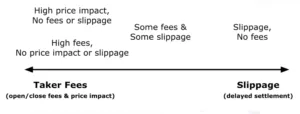

Perennial is yet another derivatives platform planning to launch on Arbitrum in the next few weeks. As explained in this Medium post, Perennial has a unique approach to trading fees that it hopes will allow it to better compete with CEXs. Many derivatives projects lean partly on dynamic fees to balance reserves, risk, and/or compensate LPs. This can result in expensive fees that frustrate users and push them back to CEXs. This concept is implemented by GMX with its dynamic funding rate based on utilization ratios and by Lyra with its variance fee. Navigating this spectrum is a fundamental weakness of AMMs compared to orderbooks.

Perennial’s bold approach uses little-to-no taker fees and high slippage. They argue that the impacts of slippage balance out to zero in the long run, and the absence of taker fees can be a game changer for rebalancing vaults and active traders. The unpredictability of high slippage is likely to ruffle the feathers of some users, who may prefer higher fees with instant execution. Nonetheless, this is a unique approach we haven’t seen before.

Outside of fee structure, Perennial’s architecture is similar to GMX, but it gives much more control to liquidity providers. LPs have the option to choose which assets they have exposure to and can take on leverage in the same way traders can. Traders and LPs alike will be allowed up to 20x leverage. Perennial’s LP design is almost like a base layer where users create their own custom GLP baskets made up of concentrated liquidity positions and directional payoffs.

Perennial will also offer permissionless pool creation. I try to keep a close eye on any projects tinkering with permissionless products, as this is where I believe the future of DeFi is going/should go. Permissionless products breed interesting design mechanisms and pose unique risks.

Perennial recently launched on Ethereum mainnet with understandably limited use. There is currently just under $4M in liquidity. Perennial is gearing up to launch on Arbitrum within the next couple weeks, which will give us much more insight into the project’s trajectory. While Lyra appears to have a very tight grip on the options space, the decentralized perpetuals race is anyone’s game. Perennial’s bold emphasis on capital efficiency and cost reduction is an interesting gamble. At a glance, it seems Perennial will likely struggle with usage early on. This design is tough to digest and will be difficult for casual users to navigate. It is likely to suffer from the same issues Uniswap v3 did, as it appears to be geared more towards professional market makers than retail. On the other hand, Perennial could be positioned nicely to benefit from the robust Arbitrum DeFi ecosystem and the composability it offers. Keep an eye on Perennial as they launch on Arbitrum.