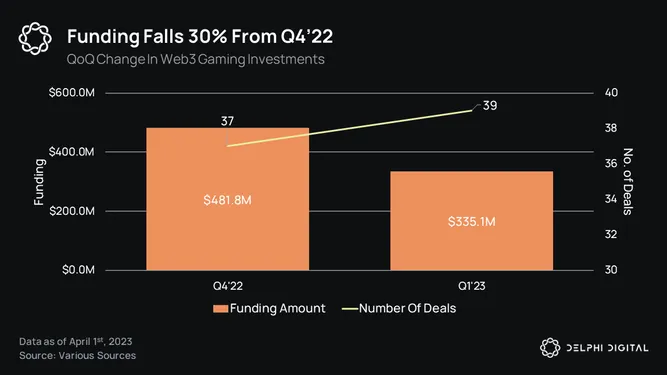

Web3 game funding continued its downward trend, with total funds invested falling 30% compared to the previous quarter, representing an 80% YoY drop.

However, when you add some color, it might not be as bad as it sounds.

👉The number of deals closed actually increased by 5% QoQ, demonstrating that there are still plenty of builders entering the space (e.g., CCP Games, Jungle, & Redemption Games).

👉Uncertain markets = more cautious investors = better due diligence. This leads to better quality projects being funded.

👉Institutional funding is a lagging indicator of growth, and many of these recent funding rounds were likely closed in Q4 2022 (i.e., when the markets got ugly).

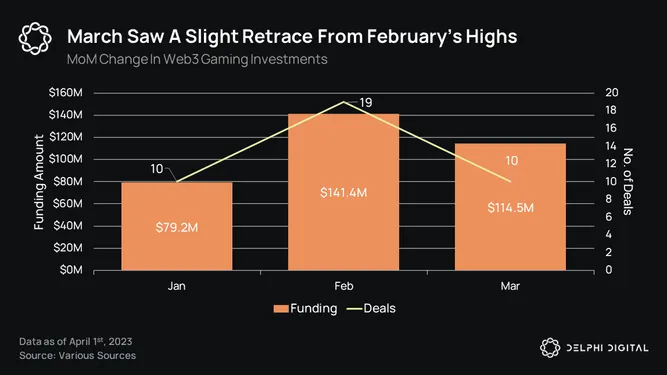

The number of deals and total funding amount dropped 47% and 19%, respectively, from last month. However, on a deal-to-deal basis, gaming projects were able to raise, on average, ~45% more compared to January’s metrics. Additionally, we have not dropped down to December 2022’s lows.

2023 is still set to be a year full of anticipated game launches, which, if proven relatively successful, will likely reignite the fire within both teams and investors.